So last week I was featured on a podcast. (If you haven't heard it, listen to it -----> here) While conversing about some of the reasons why many minorities have issues with money a sentence by me shot that led to my text messages being on fire and my apartment frequented by a few folks this past weekend. "Some folks don't even know that their 401k's invest in prison stock." I didn't know it at the time but that statement was a wake up call for a number of people, especially those with 401k's. So over the weekend I received a number of calls and visits from people who wanted to understand how their 401k's work and how they can take control of their money. So let's start with the basics....

What is a 401k?

In simplest terms a 401k is a retirement plan that is sponsored by your employer. It allows you to take a percentage of your salary (usually taken every pay period) and defer it to that plan for your retirement. Most employers match your deferment up to 5%. 401k's are invested into stocks, bonds, mutual funds, and other financial instruments that are allowed by your summary plan description.

WTF is a Summary Plan Description?

A summary plan description or "governing plan document" is a document that tells you what can and can't be invested in with your money. In short it's all the rules. This document will tell you what type of 401k you have, what's allowed, what's not allowed, how money will be invested. All of the details are in this plan.

So how does this sh!t work?

Basically you put a part of your check in this account every pay period until you retire. Your money is invested over the time period and by the time you retire you should have a good nest egg to retire with. You're not allowed to take the money out until 59 1/2. If you do take the money out before 59 1/2 you will suffer a penalty as well as pay a high amount of taxes on the money.

Why is this good for me?

Your money gets taken out of your check every pay period, you barely feel it, most employers match the money for free (up to 5%) in short if you put $1000 your employer will put $1000 in for you... for free, and the portfolio is managed by someone who is certified to do so. It doesn't guarantee that you'll be rich in 30-40 years but it's better than putting your money in a mattress. And you get to invest your money tax-free

Things to look out for....

How is my money being invested?

You need to know which stocks, bonds, and mutual funds your money is being invested in. Early in the process you can choose the types of investments you'd like to be invested in. Request your Summary Plan Description, and if there are specific investments you don't want to make, let your Human Resources department know so.

Can they change my investments over time without my permission? And if so, will they do so?

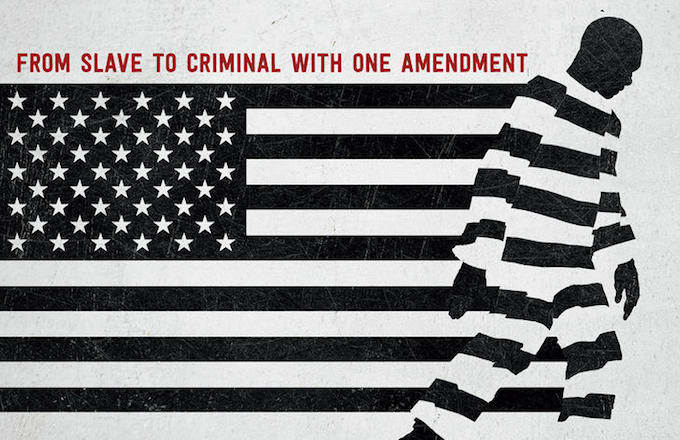

Some sponsors automatically choose/change your investment choices for you and are allowed to do so. If you elect to have more control over your account you can have that discussion with them as well. Some mutual funds that are invested in with your money actually hold stocks in prisons and you can choose to not invest your money in those if you don't want to.

Many people actually invest in prisons accidentally through this mechanism. In doing so they contribute to the prison industrial complex that has imprisoned so many minorities in the last 35 years.

Can I take my money out?

There are ways to get out of your 401k, but you'll have to take a serious tax hit. Some plans will allow you to withdraw your money if you can provide proof of hardship (you going through some serious sh!t), or was recently placed on disability. If you do want to take money out without suffering a penalty, you can borrow money from yourself and pay yourself back by increasing your payments. You can borrow your money from your 401k tax free.

There are other types of retirement plans other employers use but they operate in a similar fashion. The devil does live in the details so be very aware. If you ever need any help, reach out to your boy.

Keep stacking that paper,

CJB