Now please don’t misunderstand me. I am not saying that pro-corporate policies or capitalism has caused these positives. I am simply saying that these are all correlated. I am using these graphs to simply show the possible intent of policymakers when creating corporate & economic policy.

Why should you create a corporation?

There are many benefits to creating a corporation.

1. Limited Liability

If you are a business obtaining funds for providing goods and/or services for the public at large then it is essential that you register as a corporation. When dealing with the public anything can happen during the process of selling goods or providing services and if your business is at fault directly or indirectly you may be held liable for injuries caused by them. Lawsuits can bankrupt individuals and families and it is best to keep your personal assets safe. Creating a corporation allows you to limit your losses to the corporation alone and not anything you own personally. As stated above, a corporation is legally defined as a person, so essentially you’re just acting as another person so if someone is injured by the corporation then the corporation is at fault not you. This limited liability also extends to bankruptcy protection in which the owners of the corporation are not personally liable for the debts the corporation accumulates.

2. Organization

It is good to keep things separate. The kitchen works better when there are less chefs, tribes work better when there are less chiefs, and finances are easier to understand when they are organized in their own respective spaces.

3. Integration

It is the way our society has worked for generations. As I’ve stated in the introduction, the better the institutions (corporations) function in our society on a singular level and collectively, the better our entire society can be. In the past our institutions interacted with each other as corporations so in order to do business with other institutions effectively, you must also interact with them in a similar fashion.

4. Taxes (Depending on your registration type)

Corporations perform functions so that the government doesn’t have to. Providing this relief to the government is rewarded by paying less taxes than singular individuals. Governments also realize there are costs to operating corporations and in essence provide relief (tax breaks/credits) to companies for their operating costs.

5. Legitimacy

People tend to respect doing business with corporations more than with singular individuals. It’s just like seeing a guy in a suit versus seeing a guy in regular street clothes. For some reason representing an institution (corporation) has an air of “being official” that appears sexy to others. The process is also very tedious, so when it is clear that you have created one, it shows that you have a level of attention to detail and dedication to solving complex problems.

Types of Corporations (Profit vs. Non-Profit)

In the United States we have for profit corporations (which work to earn money from the public) and non-profit corporations (which work to provide (usually free) public services). I’ll begin with the different designations of for-profit corporations and then move onto non-profit corporations. For purposes of time I will only cover the most commonly heard corporations. For-Profit and Non-Profit.

For-Profit - Pays taxes

These structures are all basically the same but some have some minor difference which you should consider based on your goals. I will highlight some things you should consider when filing for which. You have the ability to re-incorporate whenever you want. Your choice of how to incorporate will depend on your corporate goals as well as the advantages your state gives to each designation.

LLC:

You do not expect to do a large amount of business outside of the United States

You do not expect to grow seek funding from public markets (stock market)

The Owners pay taxes on the profits. Taxes are paid as pass-through income (explained below)

C - Corporation

You expect to have outside investors (You can have as many as you want)

You expect to do business overseas

You expect to have a large employment structure in which you will have management changes (It is more difficult to do this as a C-Corp than as an LLC)

Complicated tax reporting system (ESPECIALLY IF YOU’RE PUBLICLY TRADED) Business has to pay corporate tax and owners have to pay income tax.

S - Corporation (Companies can elect to become an S Corp)

You can have up to 100 investors/shareholders (nothing more)

You expect to do a high amount of business overseas

Tax reporting similar to LLC owners only pay income tax ON THE PROFITS (aka Pass-Through income). You do not have to pay the corporate tax rate. (Taxed only once) Unless you decide to pay yourself a salary. (There’s a hack to this I will speak on below)

Management changes are not as rigid as C-Corp

Non-Profit - Does not pay taxes (I’ll add to this portion over time. Remember y’all this is a living document)

501c3

L3C

Single-Member vs. Multi-Members (Will add to this at a later time y’all… Living document status)

Single Member LLC or S-Corporations require only one federal tax return. This is because they are taxed solely on their net income and is based on the ordinary income tax.

Multi-Member LLC’s and S-Corporations require both a federal tax return and a K-1 return for the members (owners) of the corporation.

Pass-through businesses (LLC’s and S-Corp’s)

In essence a pass-through company allows owners to treat the profits of a business as income therefore paying only ordinary income tax on those profits instead of paying the corporate tax rate and the ordinary income tax. Sadly, the ordinary income tax rate (25% if you make more than 40k a year) is significantly higher than the corporate tax rate (21%). The new tax structure under Donald Trump’s administration allows you to deduct 20% of a pass-through businesses income. Basically, you’re only paying taxes on 80% of your business income. So a great strategy to maximize the amount of money you’ll get back is to pay yourself the lowest “reasonable compensation” (a calculation used by the IRS so they know you ain’t cheating) and to then pay yourself in taxes again with the rest of the profits using the 20% pass-through deduction. Your goal is to lower the amount of marginal tax rates your paid salary goes to while also limiting the amount of profit you earn as a shareholder in the pass-through business.

A great thing:

The great thing about creating (or investing in) an LLC or S-Corp is the fact that you get to realize the income (or losses) directly on your taxes as ordinary income. Ordinary income is basically income from your job. It’s a positive on either end for you. As explained earlier, the government encourages people to invest in/create new businesses because they add a positive benefit to society. The government rewards people for doing this by giving you tax credits or in other ways. So here’s two usual scenarios:

Scenario 1:

Let’s say you start a business today and incorporate it as an LLC. A clothing brand for example. You make a website, order clothes, order stamps, run ads on facebook, twitter, and instagram. You pay for wifi and other expenses to operate that business. Let’s say at the end of the first year the business does well but still doesn’t do well enough to make a profit and you end the year at a $2000 loss. Let’s say you do this clothing brand as a side hustle and you still work your regular job (at an advertising firm). If your clothing brand is registered as an LLC you can actually realize the loss on your ordinary income from your advertising job. So if you make $60,000 a year from your advertising salary you’ll be able to apply the $2000 loss onto your taxable income of $60,000 and in essence you’ll only have to pay taxes on $58,000. According to the IRS the maximum amount of losses you can deduct on your income is $250000 a year. That’s a hefty amount of money you can account for on your ordinary income taxes.

Scenario 2:

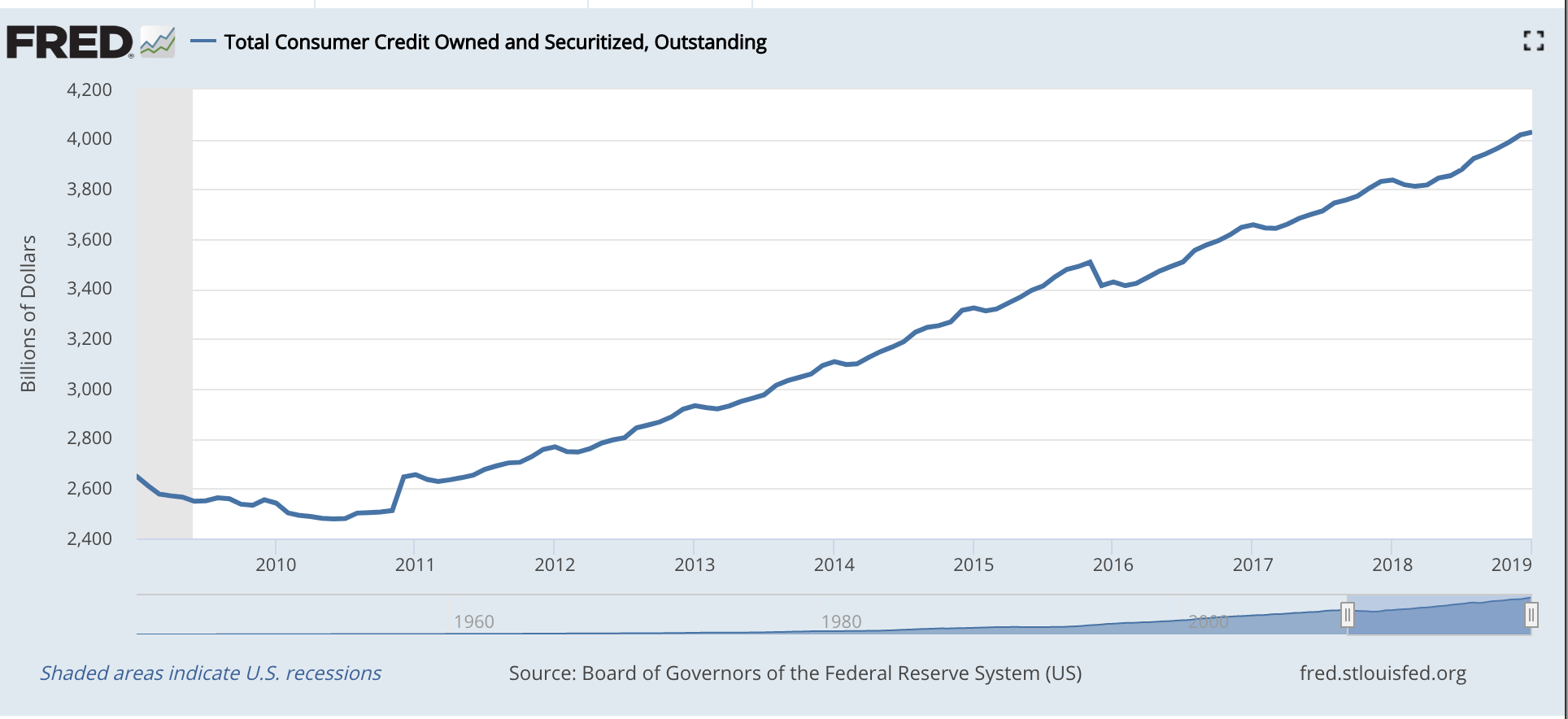

Let’s say the same clothing brand above does well and you end the year with a gain. The sad part is you don’t get to realize a loss on your ordinary income. The good part though? You get to increase your income which you can then apply to your personal credit which in essence makes you more creditworthy.

See? Registering as a business is always a win/win scenario. Y’all need to be out here playing this game.

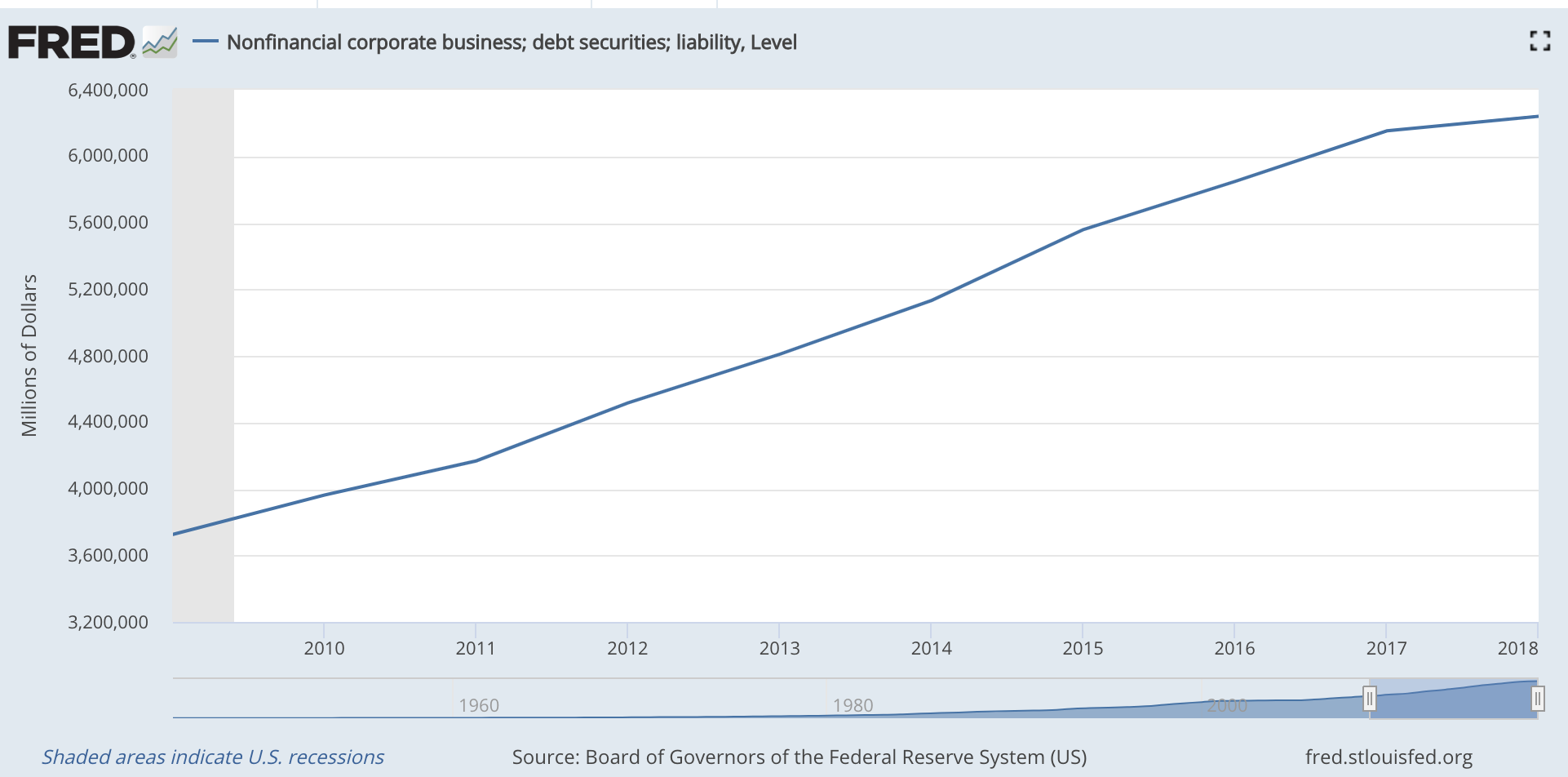

Corporate credit

Because corporations are people (citizens) they have the same access to credit as we do. When you finalize the registration of your business make sure you get an EIN number. This number is basically a social security number for businesses. As soon as you get this number, register your corporation with all of these credit bureaus. PLEASE BE CAREFUL WITH THESE JOINTS BRO BECAUSE THIS IS A SECOND CHANCE AT ELITE CREDIT.

Experian - for business

Equifax - for business

Trans-union - for business

Dunn and Bradstreet: (exclusively for businesses) Register for your DUNS number (very very important)

Trade lines of credit

If you google “Tradelines” or “Trade line of credit” you’ll probably find a plethora of conflicting information. In this particular instance, trade lines of credit means establishing business credit lines for your company. Because obtaining credit (in the form of cash) is difficult for newly created companies with low cashflow the most efficient way to establish credit is through trade lines of credit.

Usually these lines don’t give you cash at all, but allow you to purchase supplies for your company and give you a period of time to pay the balance owed. It’s like having a Macy’s discount credit card but for your business.

Some terms to know:

Net 30:

Most companies that establish trade lines of credit with businesses start you off with a balance that must be paid back in 30 days or less. This is what we call “Net 30”. You can basically run up the purchases you need but IT MUST BE PAID BACK IN 30 DAYS OR LESS. As you continue to build your credit line and it reports positively to the agencies I’ve listed above you’ll be able to apply with other companies for longer “Nets” (Net 60, Net 90).

Businesses that establish “Net” lines of credit:

Uline - You simply apply online at www.uline.com add an item to your cart, checkout, open an account and select to be invoiced. This is done instantly. Boom you got your first trade line of credit. ULine tends to start people with a Net 30 account and the website allows you to buy a significant amount of items for your business.

Quill - Whatever you can’t find at ULine you’ll probably find on Quill. Both companies operate the same way, they both allow you to establish a Net 30 line no matter how new your business is.

Over time you’ll be able to graduate to these other companies:

Target - You can apply online

Walmart - You can apply online

Amazon - You can apply online

A hack: If you want stellar business credit you can build it over time or you can buy a shelf corporation which is basically corporation that has been sitting on the shelf for years and has stellar credit. You can buy that and start getting large credit lines immediately. You may even qualify for large business loans from banks. (This is type expensive though so be cautious in using this option)

Let me know if this helps. May your corporate journey be a great one.

Best,

CJB