Forrest Gump really has figured life out lowkey if you watch the movie properly.

Before we begin I want to thank everyone who played a role in the process of me completing my first physical marathon. God, Mom and Dad for constantly telling me I can do it, @MrBeTheBetter for giving me the ill running regimen. @BoltArchitect for always providing words of wisdom. And for Bae who took this journey with me, forced me to run on all of the days I didn't feel like it, made sure I ate well, slept well, and did my necessary stretches (cause lord knows I hate stretching).

The idea of a marathon (just like building wealth) can be daunting. As soon as I signed up for the Airbnb Brooklyn Half marathon I thought to myself, why would I sign up to run 13.1 miles? And how do I get my money back? Cause this is a dub. See I haven't run much since my old track and field days in high school and even back then I didn't do no damn 13 miles. But as I labored through the process of becoming a "marathon runner" I saw so many similarities to what I love doing most... building wealth. So today we're going to get our marathon on.

Your approach: Have fun

Very much like running a marathon, building wealth can seem like a laborious process. All we want is the result. We want to reach the finish line, we want to buy the dope house and the Mercedes Benz G-Wagon, and most importantly? We want to stunt on the haters. So the process can seem so boring to us, we find ourselves in the state of "can this be over already?" And this is what causes us to miss what really matters most. The details.

Make your approach a fun one, pay attention to the details and learn how each part plays versus the whole.

In running:

Learn how to master your breathing, your posture, your pacing, your frame of mind, your diet, your running shoes, and even your music selection. Because all of these play a role in your success.

In wealth:

Learn how each investment works, how it is affected by the local, national, and world economy. Learn how changes in one investment can affect your total wealth.

The goal will seem far, but stick it out and you'll get there:

This is exactly what 13.1 miles sounded like to me.

13.1 miles seemed like an eternity to me. At the time I could barely get through 2 miles. But I set small incremental goals and tried my best to meet them and by race day I was able to complete what I once thought was impossible.

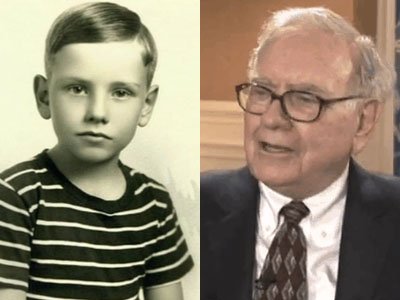

When Warren Buffett was in his teenage years he told his sisters he would be worth 1 million dollars by the age of 30. Everyone thought he was nuts, I bet he had some doubts too, but at the end of the day he kept working at his craft and by 30 he was able to reach that 1 million dollars. Keep in mind that 1 million dollars back then wasn't what 1 million dollars is today.

Find a professional for proper preparation and guidance:

This is essential. Because I thought all human beings can run, I never thought of actually speaking with anyone about running. I didn't hit up a soul I just ran and ran and ran. Through all of that running (and the internet) I learned a great deal about myself but I started to plateau. That's when I was referred to a professional who trains marathoners. @MrBeTheBetter blessed me with the tools and nutrition I needed to improve my running skill and time.

When building your wealth you should have he same approach, and you should hold your advisors to the same standard. If you're looking to increase your credit score, go see a credit score specialist. If you're looking to increase your investment portfolio, go see someone who has mastered investments (or shoot me an email cause that's my playground). Need tax advice? See a tax professional. Yes, everyone should have a go-to wealth manager who can give them a solid foundation on where to go, but everyone has strengths and weaknesses. See how you want to custom build your wealth, meet with your main advisor, and have them refer you to an expert in the field. It's just like when your primary doctor refers you to a foot specialist.

Consistency & Commitment:

Denzel is really the GOAT at motivating me

We hear this all the time and the same rings true for running. At first I thought I could just run 3 miles once a week and I'd be lit.

SIKE

March came around and I could barely run those same 3 miles. The thought of me having to run more than once a week and sticking to that schedule was annoying to me, but I had to commit to that if I was going to run 13.1 miles. My regimen changed to 3 runs a week and I had to stick to that.

Building your wealth applies the same principles. You need to be consistent about investing, you need to be committed about investing. Read newspapers and magazines that involve your investments. If you're interested in investing in marijuana, you should be buying High Times, and checking in with some of the most influential individuals in the industry. Check in with your wealth manager once a quarter (every 3 months). Your relationship with your wealth manager should be more than just a "here's my money now flip it, I'll see you later." Your wealth manager needs to be one of the people you check in with like your doctor, dentist, therapist, or accountant. Your manager needs to be the homie you know that knows money. Simple and plain.

Pacing (Don't compare yourself to others):

One issue I ran into (no pun intended lol) was people running farther distances, than I was during my training. I felt inadequate, like I wasn't going to reach my goal. It was march and everyone was doing 8-9 miles and I was only doing 5. Then I tried to run 8 miles and I screwed up my knee. The lesson I learned from that is that you have to go at your own pace. What's for you at that time is for you and you need to respect that. Different people are at different places for different reasons.

It happens to us all of the time, Instagram makes us feel inadequate. We see people having things at an age that we feel like we should have it, or should have had it already. We tend to forget that wealth goals are different for each person. Someone's goal may be to buy a home and yours may be to own a franchise. Some people may have inherited money, while you have to build yours from scratch. Everyone's salaries, and liabilities are different. Don't look at yourself as lesser than because you are not where you want to be. Believe in yourself and work toward your goal. The goal is to be wealthier than yesterday and nothing else.

There will be set backs:

Yep, I messed up my knee while training for the marathon. I couldn't run for a few weeks and I felt like it was all over. As I'm writing this I can hear my girlfriend telling me "So you just gonna sit down and give up on this race? The man I met doesn't give up on anything, or are you soft now?" I worked my knee back out, figured out new ways to run, and to not overextend myself so that I don't make the same mistake.

Being sidelined reminded me of the time where I lost a third of my money during the financial crisis. It was early my sophomore year in college and I didn't know how to "short" the market. At the time I had never lost money on the market, so foolishly I felt invincible. I sat it out, told myself "everyone will pay their mortgages, they ain't gonna let themselves live on the streets." Boy was I wrong. Lehman brothers collapsed and I opened my trading account and a third of it was gone. George Bush came on tv talking about it's a "crisis" and I knew it would get worse. I sold what I could, went underneath my sheets and cried like I was 5 dawg. I was depressed for weeks. I did some serious googling, and bought a gang of books to learn how to take advantage of this type of market.

This was me when I opened my account

I started up again in late December of 2008 and started getting my feet wet again. March 2009 came and I started making money again. This experience pushed me to major in finance in college so I can effectively learn how to maneuver a falling market. The set back made me ill for the get back. Treat your portfolio the same way.

Embrace your mission:

In January I became a runner. No one could tell me any different. I was a runner dawg. I only wore running gear, Nike dri-fit everything, I only shopped at the Nike Running shop. I only wore track pants. My Instagram timeline started filling up with Nike app posts (I lowkey annoyed some folks so I had to chill). I even built some strong relationships with people over running. If I was going to do this, I had to BE this.

You need to treat building your wealth in the same fashion. People need to know that you're looking for business and investing opportunities. When you talk to people bring up the investing side of the conversation. Ask questions like "I wonder what it costs to run a business like this?" Or "What do you think their bottom line is?" You need to exude wealth. People need to understand that you're really about your money. It's a big reason why I made the Black Wealth hats. I want people to see you and to know that you're about your business, and to take you and your investing seriously. Speak wealth, know wealth, be wealth.

It's never over:

On Saturday I crossed the finish line but I already knew it wasn't over. When I crossed the line I knew I wanted to do something like this again. The adrenaline is amazing, completing such a mission is exhilarating. The new relationships I've built through this process has placed me in a new beginning in my life, and the bonds I've built with the people in the process are cemented forever. I'm already thinking of joining running clubs, running has helped me build new habits and I feel like a better person overall. I have increased my mental toughness and I have a new threshold for pain.

My Wife Beyonce... I brag different.

Building your wealth does the same to you. You kill it in once investment and your mindset changes. Your vocabulary changes. You start speaking in acronyms such as "EPS" (earnings per share) and "P/E ratio" (Price to earnings ratio). You start looking at your environment differently and you start asking yourself and those around you... "Why aren't we investing more?" And you start building better bonds with the folks you invest with. You start to become a more informed version of yourself and you start to raise more Benjamin's.

By the end of your wealth marathon. This will be you.

Building your wealth is a marathon, not a sprint. Don't have immediate expectations of large sums of money, consider this a journey like any other. Just this one is to financial freedom. I know that you will take these words to the bank (literally and figuratively) and cash out. Good luck and always hit me up while you're in your journey, my inbox is always open to y'all.

Keep stacking that paper,

CJB