(Never forget, if you have any questions at any point text the boy Benjamin. He’s always got your back.)

I launched a new product at the bottom of this post. If you miss it, your pockets will be mad at you.

And as always…. See your personal investment professional before making investment decisions. It’s just the right thing to do fam.

And now to the post……

“Investing is just a game of knowing where everyone is going next and getting there before everyone else.”

This is 2019. It’s been 10 years since the bull market run began and all we hear constantly is good economic data. Some examples:

“We have the lowest unemployment in 50 years. It’s the lowest black unemployment ever.”

“This bull market won’t stop. It’ll never end.”

“Buy the fuckin dip.”

“There’s no downturn in sight.”

Although data exists to back these statements up. I take them with a grain of salt especially when compared to other economic data. So today, we break down my thoughts and what these thoughts mean for you.

If you haven’t heard them already, this year you’ll hear some weird phrases. Here are a few:

There’s an “inverted yield curve” in treasury rates.

There’s a “Global economic slowdown”.

We’re seeing “low growth” in many sectors.

And my personal favorite: “sector rotation”

All of these phrases will be used to describe why the stock market might be doing shitty. All of them are valid arguments, but they also leave out the fact that we’re just dealing with ordinary business cycles and people just don’t want the bull market party to end. It’s like when you’re at a party and some old dude wants to end the shit because someone was bangin’ on the damn furnace. Really it was just time for people to go home because it’s 4am in the damn morning.

It’s 2019 and it’s 4am in the damn morning y’all.

So let’s breakdown some of those statements I mentioned above.

What the fuck is an inverted yield curve?

Nope. It’s not what you do when you decide to curve that person that never texts back (I hate when that happens).

An inverted yield curve is basically when long term treasury bond interest rates (10 years or longer) become the same or lower than short term treasury bond interest rates (typically 0.5-4years). This actually doesn’t happen often. It’s rare to find that you get less of a profit for investing in America in the long term than the short term. Usually that also signals that either investors don’t find that lending the country money long term is that attractive at the moment (and that shorter term is better) or that the country is so fuckin thirsty for money right now that they like man fuck it I’ll pay you a higher return for a short term loan than a long term one. Tbh right now it’s a mixture of both.

Well. We been at war since 2001. People been broke since 2008 (probably longer really), so we not really paying much in taxes (Less Tax Revenue for the country). The government got mad debt and mad shit to pay for like right right now (social security, military, other shit) and there’s really no fix it all solution for that. Also, everyone is asking the country to wipe away them student loans (majority owned by the government) that is OD brolic so investors are like “bro how I’m supposed to lend you money for 10, 20, 30 years if you not even gonna cash in on the money that’s owed to you?” Either way.... the last few times we had an “inverted yield curve” (2001 & 2007) we had a recession to follow it.

Don’t get this fucked up. People like to use data to show causation. Sometimes shit is just correlated. What I mean by this is... well… it’s like when someone says “Everytime I feel a tingle in my knee it rains.” Well homie, the tingle in your knee didn’t make it rain outside. Just so happens... it happens at the same time. When you hear data in the financial news or see them on twitter, keep that analogy in mind.

That “Global Economic Slowdown” thing I brought up earlier? Well it’s kind of a thing. But it doesn’t mean what it sounds like. Every single business has a cycle. Let’s take an ice cream company for example. Even though ice cream is sold year round, more ice cream is sold during the summer than during the winter (because of the weather). So knowing this information, you can forecast what sales may be at a certain period.

Surprisingly, as a people, we operate in a similar way as well. When we don’t have money, we borrow, but at a later time we have to pay the money back. When countries don’t have money, they borrow, and at a later time they have to pay that back. Companies do the same thing as well. Ironically, as the stock market grew the last 10 years, much of it was done on borrowed money. I’m going to provide some charts to show how we all played a part in this. By the way all graphs below are from the time span of 2009-2019.

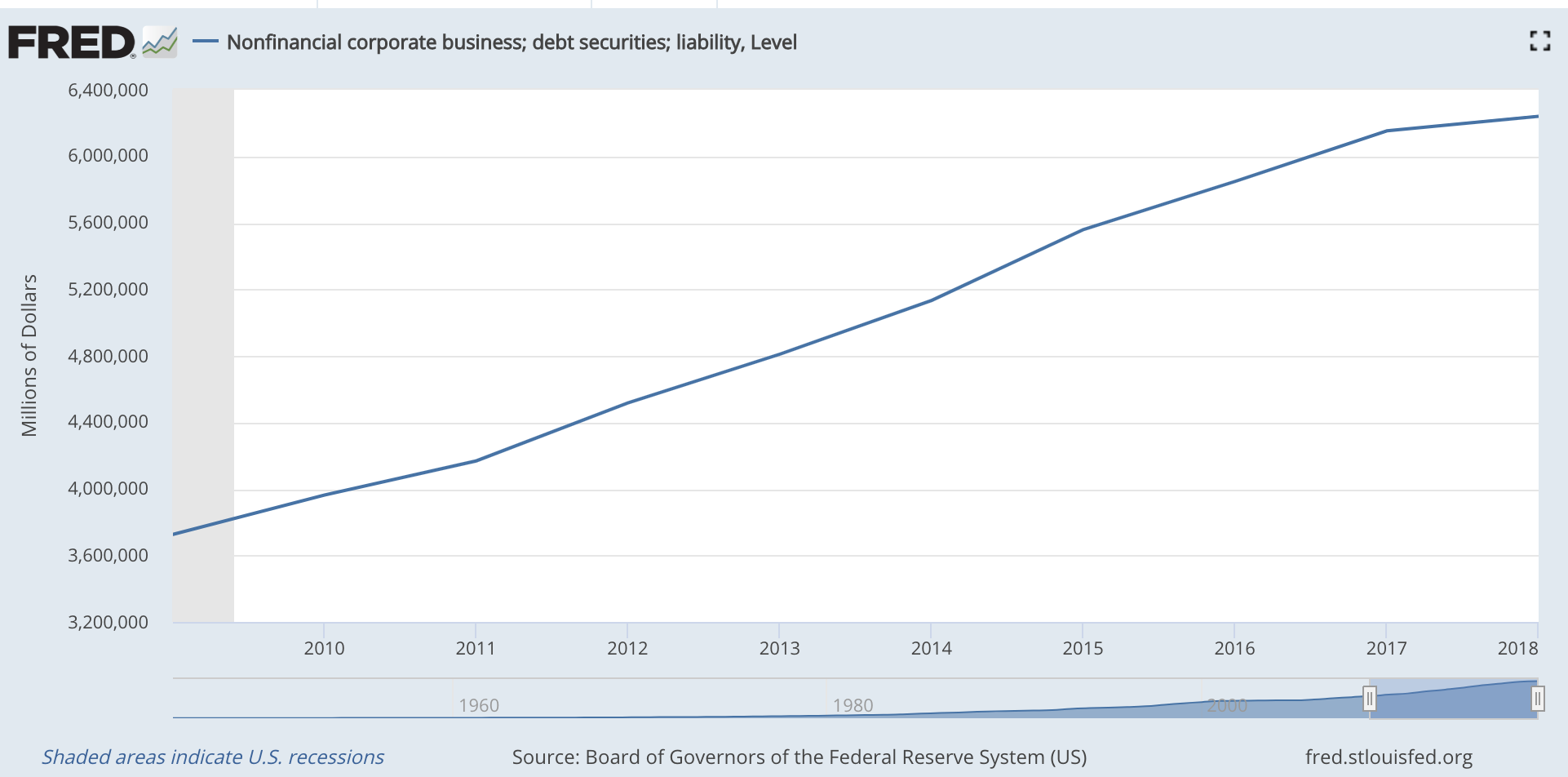

Here’s the Corporate debt:

YIKES

Stock Market Growth

BTW Companies have been using excess cash to buy back their own stock… Since they can borrow money at such cheap levels

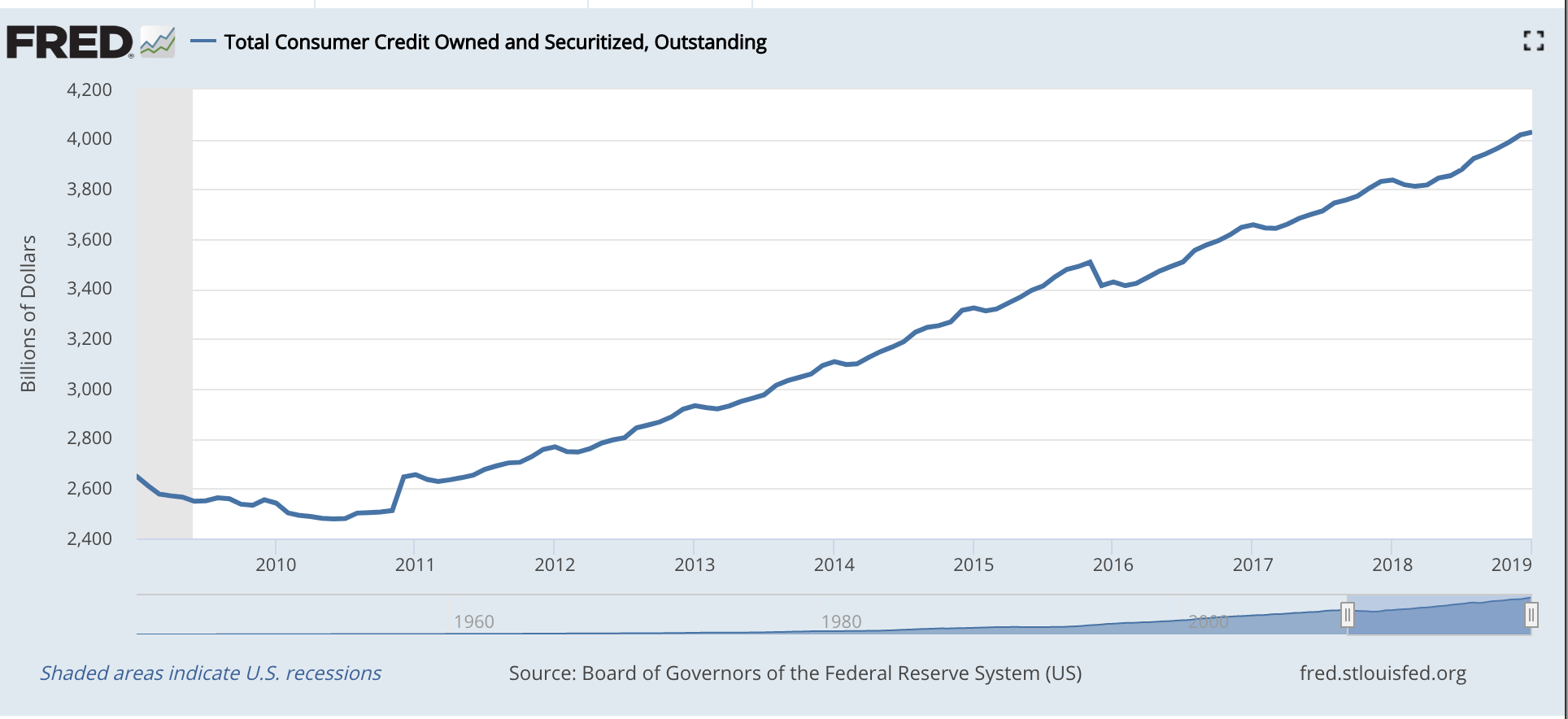

Consumer credit debt.

YIKES

Growth in corporate sales.

Wage growth

If wages aren’t growing, how the hell is the economy “growing” so fast?

GDP to Debt Ratio AKA: How much the country borrows in relation to how much it grows

It takes $105 to grow the economy $100. That’s type wild.

Well it’s 2019 and it’s time to pay back our debts. When we have to pay back our debts, we have less money to spend on other items. It’s not that we won’t buy anything…. it’s just that we will have to buy less than before because we have to budget to pay that debt back. So that means less vacations, less Louie Belts, less Gucci loafers, and less Off-White gear.

Because the United States is a country that buys a huge amount of foreign goods (items made in China, Taiwan, Europe etc) and American’s have one of the highest incomes per capita on earth, other countries are negatively affected by this. For other countries it means less money made on exports, which leads to less money to pay their employees, and less money spent in their local economies. The effect is felt globally.

Less money spent in the economy, means less money spent at companies globally which sometimes means “low growth” returns for publicly traded corporations. Since we started recording stock market activity in the United States (late 1800s to early 1900s) on average the returns for the entire market have been between 7 and 7.5 percent. This means some years we did super duper lit (22% to 28%) and some years we did super trash (-8% to -10%). Some sectors (parts of the economy) get hit harder than other sectors. For example, people are willing to buy less luxury products when paying off debts, so as a result the luxury goods sector does not provide the same high growth returns. So what do investors do?

They Rotate out that bihhhhhh!

They move to other sectors. This is what people call “sector rotation”. In essence sector rotation is when investors sell their stocks from companies in one sector of the economy and buy up shares of companies in another sector of the economy. There are many reasons for the choice of sector for investors. Some may be because the sector is less risky, the sector is undervalued (aka cheap), or there is a new (or different) sector of the economy that may see significant growth. For example, in the late 1990s when the technology sector was found to be overvalued (expensive) and providing low growth, investors sold their stocks in the technology sector and started pouring their money into consumer goods stocks (food/home items) and real estate (we all know how the real estate part of this ended).

The Nasdaq (also known as the technology index) 1999-2005

So what are you likely to see this year? Exactly what I described above. But things are a little different this time around. Many technology companies have become what I call “Multi-sector” companies and are continuing to do so. Some examples of these companies are Amazon, Apple, Google, Wal-Mart, Some of the countries largest banks, and some others. This just means that these companies have been able to play large roles in multiple parts of the economy. Amazon (damn near 1/5th of the economy in market cap) is one of the largest technology companies, but it also has become of the countries largest retailers as well as government contractors. Apple (damn near 1/5th of the economy in market cap too) has pivoted over the last few years from being a technology company to a services company. Apple provides entertainment, credit (just launched recently), and personal cloud computing. Wal-Mart has started to become more of a technology company by expanding their e-commerce while still being a traditional retailer selling consumer goods. Google has become a large government contractor and has started to move into the medical devices and healthcare field.

My advice? Build a very diverse portfolio. Your portfolio should look like the old school food pyramid. Ya’ll need to have commodities in there, utilities in there, stocks from all sectors in there. There’s no reason why your portfolio should be majority weed stocks, or crypto, or tech. Just like you need a well balanced diet, you need a well diversified portfolio.

More Greens Please!

I’ll be providing commentary this entire year. When I mean commentary, I mean COMMENTARY. I’m launching a podcast, I’m doing live online chats, I’m dropping videos of different investment strategies, building your credit, and I’m dropping fire analysis from the best sources in the industry. Members also get free gear (which I’ll be rolling out a ton this year). I’ll 100% still be providing free #MoneyMail but getting the access to all the information i’ll be providing in private is costly both in time and actually money. So if you want in… You can join The Black List by paying a yearly fee. For that info shoot me an email at carl@raisingbenjamin.com…..

I’m fully confident that y’all will see your way through this year because y’all stay coming here and catching these gems. Even if ya’ll don’t sign up for The Black List y’all will be fine because y’all are smart as shit. You know where to find me and you know the vibes…

BY THE WAY. CREDIT CARDS GONNA INCREASE CREDIT LINES OD THIS YEAR SO THAT THEY CAN SPUR SPENDING AND “GROWTH”. I NEED Y’ALL TO TAKE THE CREDIT LINE INCREASE, BUT DO NOT SPEND THE MONEY. USE ONLY 20% OF THE WHOLE LIMIT OF THEM JOINTS AND RAISE YOUR SCORE. DON’T FALL FOR THE OKIE DOKE DEBT TRAP AND GET THAT CREDIT SCORE CLIPPED.

Keep Stackin’ that paper,

CJB