I bought my first share of stock in McDonald’s at 14 years old. It was during a visit over my Father’s house in New Jersey. He saw that I really loved math, and we had spent years reading The Wall Street Journal together on days that I would go and work on the trucks with him. My dad ran his own business, he had a small fleet of trucks that made local and multi-state deliveries. So during the summers when I would visit my dad, he would wake me up at 4am and help him run his business. He’d have me look at the price of oil everyday and translate that to how much the price of gas would change at the pump. He’d have me contact all of the drivers and make sure they were prepped for their deliveries. He would even take me on deliveries and have me unload the truck with him. For all of these days I worked with him, he would pay me based on my enthusiasm for work, and how well I performed that day. He would also do annoying shit like take taxes from me (who takes taxes from a kid? smfh). But one of the greatest lessons he imparted upon me was understanding the stock market.

So as I saved money and began to invest, I stuck to what I knew at the time. Buy low, sell high. I didn’t know anything else. I only knew how to identify value in businesses and buy early. As I grew through my high school years I became better at identifying business opportunities, and using resources to earn dollars. I used my step-dad’s blank DVD’s and movie software to sell DVD’s wholesale to classmates who would in-turn sell them to other classmates in school. I shoveled snow for money during the winter with my best friend. I worked with my dad to earn extra money. I bought and sold sneakers. Throughout this time I would always take a piece of that money and invest it in businesses I saw that were cheap in the stock market. Boeing (because I loved airplanes), more Mcdonald’s because I loved Mcdonald’s, Microsoft because damn near every computer I saw growing up was a windows computer. Over the years I had made a ton of money by investing in value and in one day at the age of 19 I opened my trading account and over half of it was gone.

Yep, Lehman Brothers collapsed and in like 4 days I damn near lost almost all my money. What’s crazy is that I knew the market was going bad too. Nothing made sense for a long time, but the issue I had was that I didn’t know what else to do with my money but to “buy low, and sell high.” The writing was on the wall. In high school I knew a shit ton of people who bought houses, flipped em, did all kinds of shit, I even had an aunt who I personally knew made less than $30,000 a year who bought 2 different homes in less than 4 years, one for $700,000. She even bought a BMW. I looked to myself and asked if someone who makes significantly less than my parents can buy all of these things, the economic environment is truly messed up.

Back to the main lesson at hand though.

I lost over half my money. I cried for days. I sat in my room and didn’t tell anyone. I was embarrassed, how could the kid that knows everything about the markets, lose damn near everything? I can tell you how….. I didn’t know how to create a portfolio for a market downturn. I only knew how to “buy low, and sell high.” I didn’t know how to protect my investments, how to hedge my portfolio, or what investments did well in a market downturn and today, that’s what this 3-part series will be covering.

Losing all of that money taught me that I needed to get out of my shell and learn more. So instead of majoring in philosophy, or economics in college, I decided to major in Finance. I upped my game, and learned not only how to create a portfolio for a market downturn, but how to make more money in the stock market while taking less risk. Here are some of the financial instruments I learned about while in school, and eventually executed in my portfolio.

Options:

On the stock market people like to make bets. These bets can be made in many different ways. Some make a bet by buying and holding their investment in the company, and some make bets by making deals with others to buy or sell shares of stock at a later time. This is primarily what options are.

At its most basic structure, an option is an open market contract to buy or sell (1000 shares at minimum) a stock. Now it’s name clearly means its name. An Option which means you have the option buy/sell or you can just allow it to expire when the time period is over.

An option is insurance. You don’t plan to crash your car, but you want to be able to pay for damage and replace your car if you do crash it. You may want to purchase/sell a stock within the next few months, but aren’t really sure how well the market or stock will do. So you purchase an option for a few months so that you can purchase/sell it at the same price a set price.

Options are very inexpensive in comparison to purchasing stock, and also help you bear less risk. You get to have the right to own the stock, buy/sell it if you want, but if you’re still unsure, you can just let it expire, and you only lose the amount you paid for the option (the premium).

Some may look at this like a waste, but this is actually a risk averse way to invest. Here are some types of options.

Call option:

Let’s say you see the price of a stock today at $3 a share and you believe the stock will do better in the next 6 months, but you aren’t completely sure and don’t necessarily have the stomach to deal with the up and down market trends. You can purchase a call option that day for a certain price.

If this sounds kind of complicated, check out this video below.

Put option:

The put option is the same exact structure as the call option, but it is made for someone who thinks a stock costs too much.

Here is another video that explains a put option in a short simple way.

PS: I’ve been purchasing put options on Snapchat for the last few months. If you follow me on twitter this is why I keep yelling “Snap at $10”

Investing in commodities: In particular, Precious Metals.

Gold:

Because if all else fails we can trade gold right? When markets go bad millions of investors flock to the safest currency on the planet. Gold. It’s always necessary to have Gold in your portfolio and if you feel like the market might go to shit, it never hurts to buy more.

Gold is $1277 per ounce

Silver: If Gold is too expensive, silver is always the cheaper option. Investors love to flock to silver as well.

Silver is $16 per ounce, and $543 per kilo

Copper: From a safety standpoint investors also flock to copper. But another good thing about copper is it’s usage. Copper is one of the most useful metals in the world, so owning copper is a double win for your portfolio.

Copper is $3 per ounce, $6 per kilo

ETF’s:

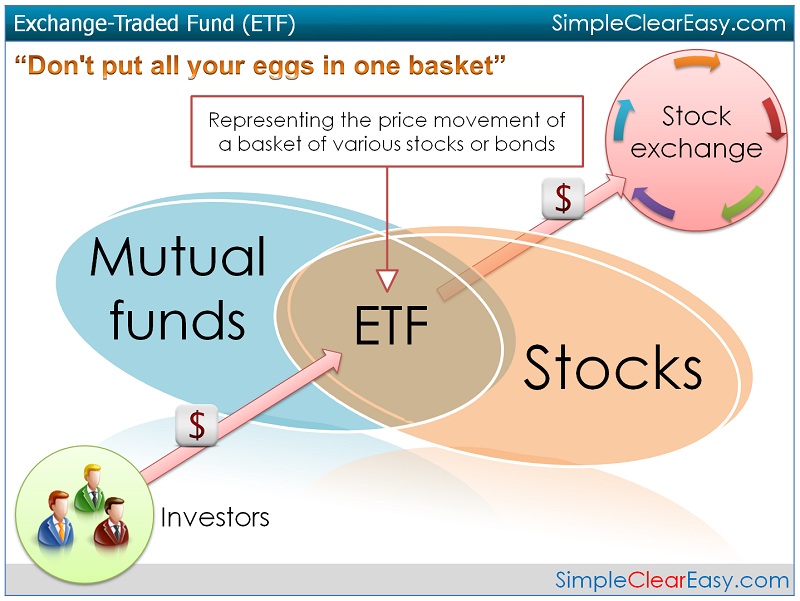

If you follow me on twitter, you’ve probably seen me talk about this a number of times. ETF’s are short for Exchange Traded Funds. These relatively new financial assets are index funds on steroids, but are cheaper and more liquid than mutual funds. Exchange traded funds allow you to own a larger amount of assets and have a cheaper entry point. Here a few ETF’s below:

GLD: This is the largest Gold ETF by asset size. It currently holds over $35 billion in Gold assets. This includes mining companies, mines, and shares in Gold operations. Remember how I told you that Gold is $1277 per ounce? The GLD price is $121 per share. Yeah, it’s that lit. You get to own assets in Gold that are way more liquid than holding the ounces, for cheaper the price.

SLV: This is currently the largest Silver ETF by asset size. It currently holds over $5 billion in Silver assets. It is currently on the market for $15.85 per share.

JJC: This is currently the largest Copper ETF by asset size. It currently holds $68 Million in Copper assets and currently trades for $34.43 a share.

All markets aren’t risky, this is just the beginning in building a safe asset portfolio. Stay tuned for part 2, on its way next week.

Keep Stackin' That Paper Y'all,

CJB