Name 5 things that come to mind when you hear the words "Stock Market". I'm pretty sure within the 5 things money was one of them. Lots of money. Millions. Throughout history fortunes have been built in the infamous stock market, but it's always been this mystical black box to many of us. To be completely honest with you, it's not rocket science. Many of the worlds greatest investors have said the same... over and over again.

"All the math you need in the stock market you get in the fourth grade" - Peter Lynch

To be completely honest it's mostly true. Investing is 40% information, 40% perspective, 10% patience, 10% discipline. With that being said here are the basics of the game:

Investing is business. Point blank period. The market is the place where people buy and sell products or services, and the price is set on the basis of what people are willing to buy or sell that product or service. Every stock is a business, treat it as such. If the business has a bad owner, or bad management, the stock isn't likely to do as well. If sales of a business are down, the stock isn't likely to do well. If the price of doing business for a company drops? The stock is likely to do well. The entire market can be boiled down to real decisions we make on a daily basis.

Why the stock market matters:

This 30 minute video gives you a break down of how the economy works and within this is the importance of the stock market.

Some words to pay attention to and what they mean:

Share(s): Ownership within a company. The more shares you own, the more ownership you have.

Stock Price: How much everyone on the market thinks a company is worth.

Price/Earnings Ratio (PE Ratio): A company's share price to its per share earnings.

Earnings per share: The amount of profit a company makes divided by the amount of outstanding shares.

Yield: The percentage amount of income (through interest or dividends) you earn by owning a particular stock or bond.

Now to the how:

Best apps for investing:

Robinhood app: It is by far the simplest investment app I've ever come across. If this is your first time investing I'd recommend using this. Design is simple and easy to use. It's cheap. And there isn't all of this super investment mumbo jumbo.

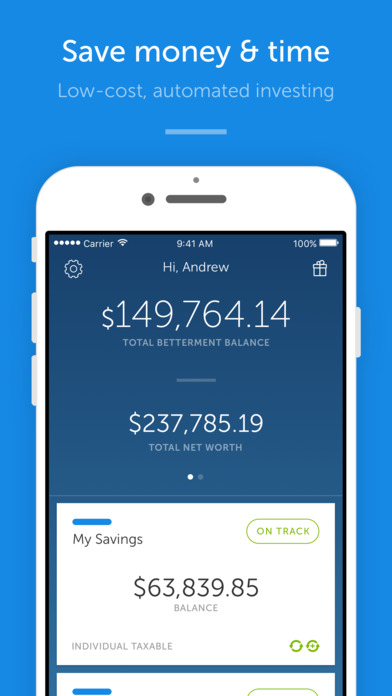

Betterment: Betterment is the product/service you probably hear about as an ad before your favorite podcast. This is within reason. It is the perfect app for the passive investor. It uses technology to automate your investment decisions for you based upon your needs, and goals. If you don't know how to invest, and don't have the time to do so, you either you this app or you invest in an Index Fund.

Philosophy

Many people have different investment philosophies. Mine in particular is rooted in value investing. I look for good companies, who are valued at great prices. I personally look at investing in the same light as I look at products. I look for quality, a great brand, a fair price, and something that will bring me value in the long term. To me it's like buying sneakers, if I find a great pair of Nike's on sale, I'm coppin. I'm not in the game to make 1 million in a day, I'm in the game to increase my portfolio 10-12% a year.

Other folks buy stocks for different reasons. Some buy them for dividends, some buy them for short term growth, some buy them because of volatility. All in all, you have to make the decision for the stock you purchase. Just make sure it makes sense to you.

This weeks email comprises of unlimited bars to get your investing started. If you still need some help suiting up don't be shy, reach out to your boy. @CJoeBlack on all social platforms.

Keep stacking your paper,

Carl