Damn right it's another board game reference, cause these board games teach us the values necessary to making it through life. Also because my nerdy ass loves board games and people don't play enough with me :(. Another one of my favorite board games is the game of LIFE. Although it doesn't focus on one subject like monopoly, it teaches us that life is more than just managing real estate, and investments, but that every decision we make is important to our lives and our loved ones. This game also shows us that this life is a mixture of preparation and luck, and that the more prepared (the better decisions you make) you are the luckier you get. So this week we will get prepared for the inevitable by getting a crash course on life insurance.

I know this shit is grim, but until Google completes the Calico project, we have to plan for death to continue rearing its ugly head. To be honest, as much as I love y'all I don't want to be out here donating to your Gofundme accounts because you weren't responsible enough to get some sort of life insurance.

Although associated with death if done properly your life insurance policy can actually be very beneficial to you while you're alive. It can get you approved for loans, it can be a source of funding for your business, it can even be used as an asset. Today we will learn how some of these types of life insurance products work and how each can be advantageous to us. We will learn what strategies we can use to maximize our wealth, pay the least amount in payments, and leave a great estate when we're gone.

Disclaimer: Because of how detailed each type of policy can be, we will only cover these in a broad sense cause I can't have y'all here on RB all day I know y'all got shit to do. But if you need more details see an agent, but use this post as ammo so you can ask better questions and make very informed decisions.

Whole life insurance:

Some call this straight life insurance others call it whole life insurance. In short this type of insurance has only one term, from the moment you get it to the day you die. This is the type of insurance that costs slightly more but is very beneficial when you sign up at a younger age. With a whole life insurance you can borrow against your policy to invest in your business, or pay for tuition for example. It's always smart to borrow from this type of policy because the interest rates are lower than your standard interest rate on the market.

There are a few types of whole life insurance:

Ordinary:

The standard type of life insurance. You pay one premium for a fixed policy your whole life until you die. It comes with a savings element that allows you to earn dividend payments from the insurance company over time.

Universal/adjustable:

This type allows you to increase the size of your pay out when you die if you pass a medical exam. It also comes with a savings element that earns interest. You can use the earned interest as payment if you can't pay one month so your policy doesn't lapse.

Variable life:

Allows you to use your life insurance to invest in the stock market. It's riskier, but you can earn money on top of the policy.

Variable-universal:

The mix between the 2 previous options. You get the investment option and you also get to adjust your payments based upon your economic situation so you don't lose your policy.

The next type of insurance is.... Term Life insurance:

This type of life insurance allows you to have life insurance for a shorter period of time. The standard is usually 10 years. After the term is up you have to reapply for another term. This means you have to take another physical every 10 years which means your premiums are likely to increase every 10 years. The older you get the higher the risk that you will die.

The two main types of term life insurance are:

Level term:

The policy pay out stays the same the entire 10 years. If you get a policy for 100k it is 100k for all 10 years.

Decreasing term:

The policy pay out decreases each year throughout the term. So year one it's 100k, year 2 it's 90k, and so on.

For the crib....

Mortgage Cancelling Life insurance:

This insurance is a promise that will pay off the remainder of your mortgage if you die. So typically the term on this type of insurance is as long as you have a mortgage to pay.

Tip: Find out if your mortgage cancelling insurance payments decrease over time. This is important because as you pay down your mortgage the value of the policy loses value. This loss in value should reflect in monthly payments. You can also refinance your mortgage life insurance as your pay down your mortgage.

The Term life v. Whole life battle:

Some say term is better than whole life, some say whole life is better than term life. I say it depends on your age, health, and your forward outlook.

The younger the better for whole life insurance. Getting a whole life insurance in your 20s is more useful because you get to take advantage of the perks that come with it. Although the payouts are smaller the benefits work out when it comes to borrowing against it or using it as an asset.

A term life insurance works better when you're older because the payments are cheaper and the payments are larger for the price. The downside is that you have to take a physical every 10 years for a new policy, and if you get sick or don't pass your physical you can get denied life insurance. So it's riskier.

For the kids:

It's grim to think about life this way, but being prepared is key. Get a Gerber life insurance for your child when they are born. The cost is only $5 a month for a $15k policy. It's whole life insurance for your child. You can also pass this life insurance onto your child when they're old enough to make the payments themselves. They also can use that same policy and increase the payout for themselves at a much lower rate than signing up for a new policy. Being a responsible parent and winning the game of life costs less than a Netflix subscription every month.

Strategies:

Ain't nothing wrong with mixing and matching. You don't have to choose one policy and stick to it. Here's how I approach life insurance:

I currently have a whole life policy that covers my funeral costs and my student loans.

When I get married I'm going purchase a term life insurance that I will give my wife a payout if I pass away, that I will update every 5 years based on how our marriage is doing.

When we buy a home together we will each have mortgage cancellation insurance to pay off the mortgage should anything happen to any of us. This policy will be updated every 5 years because of the amount of money we will be paying down on the mortgage over time.

When we have children we will get Gerber life insurance for each child and pay that for them until they are old enough to inherit the policy and move forward.

Although it sounds expensive but the total of these policies can equal to less than 80 dollars a month.

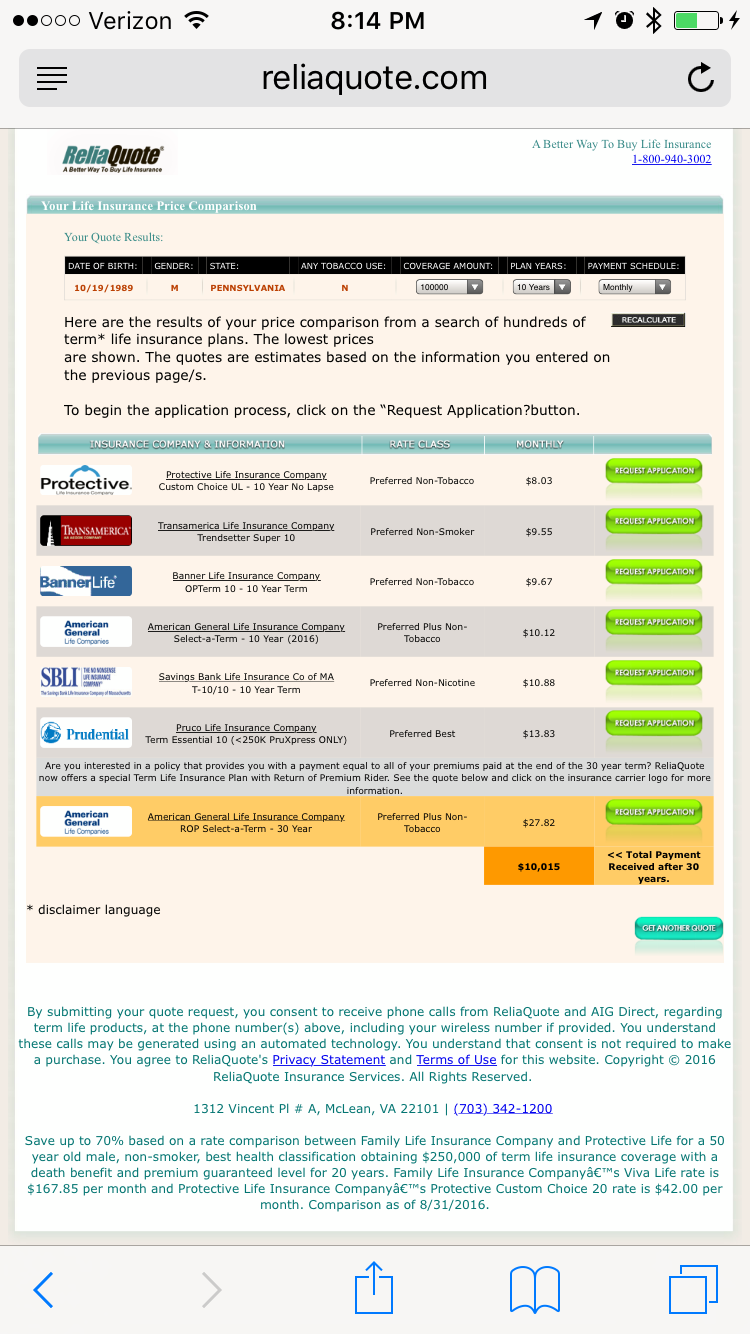

According to Reliaquote.com

I can currently get a Term life policy for 100k (the minimum) for $8.03 a month. My current whole life policy costs me about $30 a month for a 75k payout

Right now we're at $38.03 For a policy total of 175k.

That's less than your cell phone bill.

The part we always forget:

Insurance approvals and monthly payments are based on your physical. If you do not pass your physical it will be difficult to obtain a policy.

Here are some hacks to increase your chances at passing your physical.

Eat better: You should be doing this anyway, but eating your fruits and veggies helps you pass your physical.

Stop smoking: You should be doing this anyway. If you don't smoke, this ain't a problem for you.

Take your physicals in the morning before breakfast. Our bodies are fresh and fasted.

A week before the physical:

Chill on the salt. High sodium gives vibes of high blood pressure, that leads to higher payments.

No liquor. Alcohol reflects poorly on physical exams.

Get a copy of the health questions that will be on the exam and answer them before you go. This will help you answer them better on the day of your physical.

If you're sick on the day of the physical, stay that ass at home. Don't be a hero and mess your money up.

If you fail your physical:

The world isn't over. Find an insurance agent. This process will cost you more but they can find a company that will strike a deal with you.

Other options:

Life insurance with your job:

This is usually standard with companies but the term ends when your tenure with the company ends.

Group life insurance:

Volunteering with the fire or police departments can earn you life insurance for free or for cheap. Some unions also provide life insurance for people who decide to join.

Getting insurance is necessary yall. You get insurance for your car, for your phone, why wouldn't you insure your life? Although we've barely scratched the surface on this subject, I hope this puts you on the right track to asking the right questions. I wrote this because I care about you, your wealth, and the wealth of those who love you.

Speaking of Wealth....

The hats you've all been waiting for are here!

When I first created this newsletter, the objective was to change our relationship with money. This collection embodies that, it shows us that our history is not only one of struggle, but also one of Wealth. Black Wealth.

Click the photo below to preorder the Wealth Collection by RaisingBenjamin.com

Buy, enjoy your hats, and most importantly,

Keep Stacking that paper y'all,

CJB