Yerrrrrrrr. It’s been a while. I really missed y’all. It’s year 2 of the war called law school and this young Soulja has learned some new tricks. Of course with great power comes great responsibility so it would be trash if I didn’t share some of my learnings with you. Next semester is on it’s way and it’s going to be even more aggressive. Added to the plate? A position at the American branch of a foreign bank monitoring Forex and Overseas Investment Traders with the added responsibility of signing off on Billions of Dollars of loans to companies. Everything has to be peachy with the government and I have to make sure that people aren’t sending $$ to people that shouldn’t be receiving them. It’s fun to a nerdboy like me, but y’all probably falling asleep as you’re reading it. In short though, the emails won’t come as often, but if you have ANY questions about ANY financial stuff don’t forget I created the financial assistant “Benjamin” to help you out. So make sure your curious ass asks away. I love helping y’all. Let’s move on to more pressing matters though.

How the markets been treating me lately

So…. You opened your account and its bleeding red like Kill Bill Vol. 2. I get it. I’ve been there. If you’re a Raising Benjamin OG you already know my 2008 story. Click that link in case you didn’t know or forgot about the horror. Along with learning risk management, alternative investments, and simply crying through it, I’ve learned some new things. Because law school teaches us how to read statutes and the IRS along with Bloomberg and Westlaw gives your boy access to help from professionals I found out that you can use the tax code to offset your losses.

Oh WORD?

Yeah so remember that Corporate Takeover thing I wrote for y’all a little while back? Just so happens I found that investing in building actual businesses isn’t the only way to recover losses from the IRS. You can recover money from the IRS for investing in stocks, bonds, and other financial instruments as well. These my friends are what your good ol’ homies at the IRS call “Capital Losses.” Let’s take a walk into what this “Capital Loss” thing is, how it works, and how we can make it work for US.

Take a walk with your boy

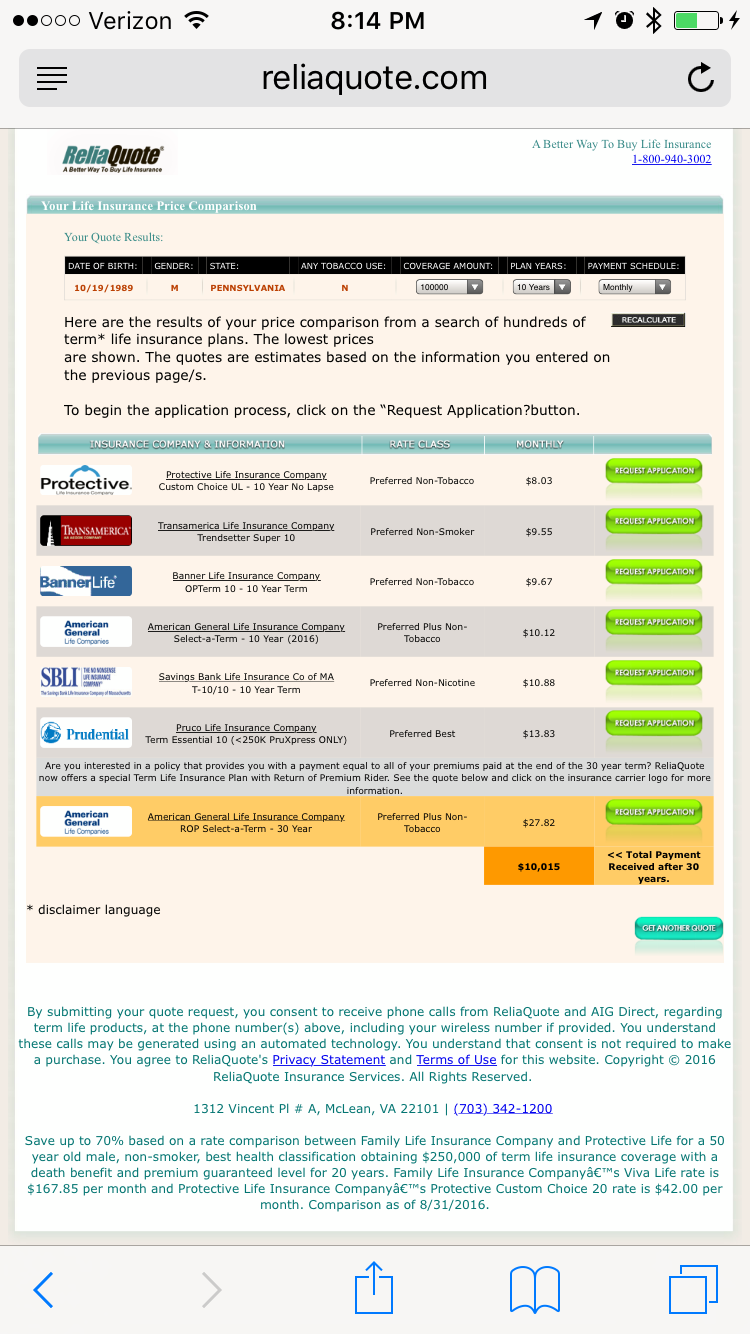

When you make money on any investment the tax man comes through and says pay me. Why? Because if you’re going to make money in America our favorite Uncle, the one that’s never drunk, Uncle Sam, wants his cut. He will always… ALWAYS… Choose you. So the tax he wants from the money you’ve made from selling and investment at a profit is called “Capital Gains.” If you sell your position in an investment in less than a year (called short term “Capital Gains”) Uncle Sam and his squad at the IRS will tax you according to what we call “ordinary income” which in short is the same tax rate as what you get taxed from your regular job. But! If you sell your position in an investment in more than a year (a year and a day to be technical) Uncle Sam will put you in the “Long Term Capital Gains” territory. Now these taxes are significantly less than your “ordinary income” tax rate. As a single person in 2018 if you made less than $425,000 a year that tax rate is only 15 %. Yeah. ONLY 15%. This neat tax trick (among many others) are one of the primary drivers for long-term investing.

Uncle Sam really about that bread

Of course with the possibility of gains comes the possibility of losses. When you lose money on any investment, you’d assume that there’s nothing to tax right? Well you’re right… BUT…. The IRS allows you to claim the “Capital Loss” against your gains (from other investments) or your ordinary income (if you don’t claim any gains). Claiming your “Capital Loss” allows you to deduct your tax liability for that year. Your tax liability is basically what you owe in taxes for that year. There are limits to this though. Single people get to claim up to $3000 in “Capital Losses” per year. Don’t fret though, if your losses are beyond the $3000 then you can claim the rest of the losses the following year. So let’s dig through a few scenarios.

Scenario 1: Let’s say you made $80,000 this year and your tax liability is $20,000 for the year. If you took a “Capital loss” of $3000 your new tax liability would be $17,000. That’s $3000 you don’t have to pay to the government in taxes that year and if you paid your taxes already that is a possible $3000 that you may get back in taxes due to you overpaying.

Scenario 2: Let’s say you made $80,000 this year and your tax liability is $20,000 for the year. If you took a “Capital Loss” of $6000 your new tax liability would still be $17,000. The government would allow you to claim the max ($3000), but would allow you to “Carryover” the rest of the loss into the next tax year. That means you can claim the remaining $3000 the next year toward your new tax liability. So in essence you can use this “Capital loss” strategy to make you square aka leave you with the money you started.

I gotchu Fam

How do I claim my losses? Shoutout to the IRS because they got the 1040 Schedule D form online for all of us to fill out. Your investment broker should send you some tax forms as well. Take those, fill em out, see your accountant, and go claim your losses. If you SOLD your stock at a loss already you can claim the loss. If you haven’t sold your stock at a loss and have decided that you want to get out of the game….. YOU HAVE TO SELL BEFORE DECEMBER 31st TO CLAIM IT FOR THE TAX YEAR THATS COMING (2019). If you wait until (or after) January 1st then you have to claim it in your taxes when you file them in 2020. There’s also a carryover form if you plan on carrying those losses over into the next tax year.

Why does the government allow us to do this? Because they want people to invest money. Investing is good and tax policies such as cheaper tax rates for Long-Term Capital Gains and deductions for Capital Losses creates an incentive for you and I to jump in and take a risk. If you want the word from the OG’s at the IRS I got you too.

Should you get out of the game? That has to be a personal decision. My investment goal is always to invest for the long-term which means I have to deal with market swings such as the one we’re living through now. I do make short term investments here and there, but for the majority I’m long-term. For some real advice you should stop by your local investment advisor, someone who knows your finances intimately and can help you decide what you should do more accurately. For now? Go open your gifts, drink Coquito, and catch the NBA games. I love you guys for ever and if you have any questions feel free to email me or text the boy Benjamin.

Happy Holidays,

Your Boy,

CJB

Disclaimer: Please use your own due diligence before making any investment decisions. Past performance does not guarantee future results.