I know… It’s been a while. Been experimenting with new ways to release this and came down to the fact that this is indeed the most efficient way to do it. But less talk. More Money. Here’s your recap of The Dime for the first full week of the New Year. Happy 2020 y’all. May your checks be enormous, investments be plentiful, and may you reach nirvana, peace, or whatever you call true happiness.

The Dime 1/6

Markets

1. Markets: After rallying last year and early this year, Markets have been rocky the last few days since the Iran drone strike that killed one of its high generals (I’ll address this soon). Today the Dow closed up about 68 points (0.24%), the Nasdaq closed up about 50 points (0.56%), and the S&P 500 closed up 11 points (0.35%).

2. Uber has expanded its business to bus ticket sales. Uber has launched “Uber Transit” which allows Uber users to buy tickets for buses on its app. Uber will also tell users when their bus is coming, how long it will take to arrive at their destination, as well as providing the same information for other methods of transportation. Uber is essentially trying to become the center of transportation. Currently, the head of Uber Transit has stated that there is no charge to the transportation entities it serves. It has officially launched in Las Vegas and hopes to move into other cities before the end of the year.

3. More and More investors are trading options instead of trading traditional stocks. If you’re subscribed to the Raising Benjamin Newsletter you learned about this a while back when we covered “Derivatives”. Options are cheaper than investing in stocks and are usually used to hedge your investments (limit your losses), but individual investors have started using them to gain earn more money by making bets on stock movements and paying less for them. To add to this many online brokerages have been softly promoting options trading to their users because it makes them more money. The spreads between options are higher and you can charge additional fees for trading options versus stocks (which at this point are FREE to trade). Be careful out here y’all, don’t get caught wilding with these options. Invest smart, don’t be greedy.

Food

4. Some developments in the Cocoa industry in West Africa. If you remember from our previous Dimes…. Ghana and The Ivory Coast have been charging a “living cost differential” fee of $400 on top of the current price of Cocoa. For context, Ghana and The Ivory Coast together trade 60% of the world’s Cocoa. With this power, Ghana and The Ivory Coast have decided to create their own trading group that some other governments and businesses are calling “COPEC”. This name stems from “OPEC” which represents the group of countries who together form the largest oil trading bloc. This play by Ghana and The Ivory Coast is HUGE and will influence the prices of chocolate for a LONG TIME. Although the price of chocolate is going to increase, I look forward to how much this agreement positively influences their economies. Stay tuned y’all.

5. Home sales in wildfire areas in California have slowed due to the difficulty of prospective buyers to get insurance on those homes. The lack of insurance contracts has played a role in many of them backing out of the home-buying deal in general. Insurers are looking at these wildfire regions as high risk and are charging significantly higher amounts to insure these homes. This could lead to trouble for California because large regions of the state have suffered wildfires this year and with insurance companies reacting that way it may lead to insurers raising prices on towns and cities that are near these regions. Also, the insurance costs might actually force the sellers to lower their prices dramatically to factor the costs in.

6. TikTok’s growth has caused it to become a major player in the social media space and with this comes politics. In recent months TikTok has been flooded with political content from users and it appears that it will continue as the Presidential Campaign continues to take off for 2020. Specifically, TikTok will become a battleground for the youth vote due to the fact that out of their 24 Million active users 42% of them are between the ages of 18 and 24 years old. I’m already annoyed because I know all these old ass Presidential candidates are going to be on TikTok talking that “vote for me” shit. Also, I’m just tired of everything being so politicized. Remember when the internet was just jokes about our lives? Now everything has a political spin in it. Smh for much for good times.

IRAN

7. OK… So we all know what happened with Iran’s General. I’m not going to share my opinion on it because tbh my political opinion doesn’t matter. What you really want to know is “How does it affect markets?” well…. Iran is in the top 5 countries of oil production. More importantly, Iran takes up a majority of the coastline in the Persian Gulf and now with strained relations in the middle east, they may be thinking of retaliating by acting aggressively in the Persian Gulf. Iran also has significant control over the Strait of Hormuz which means it’s going to be difficult to get oil out of Eastern Saudi Arabia, Southern Iraq, and the United Arab Emirates. So as Iran starts to act up and oil starts to become difficult to move from that region we can see some prices pushing up due to uncertainty. This is by no means investment advice, just context. I’m providing a quick map so y’all can understand what I mean.

8. Oil and natural gas industries are loving this by the way. The US is also Top 5 in oil production and Natural gas (fracking oil) has been playing second fiddle in the oil world for a while, this supply crunch can actually play well to improve natural gas sales and help those natural gas companies who’ve been taking a slight beating due to oversupply and taking on a bunch of debt. Some people are seeing a supply-side recession mid-2020 which I can see the argument for. In short, a supply-side recession is a recession that is caused by a significant shortage of supply from a particular resource which causes prices to jump up because demand has not fallen to match the fall in supply.

9. No onto the World War III talk. I’ve been thinking about this recently and I’m not 100% sold on it. I’m not saying it’s impossible but let’s use that map I shared with you as perspective. Iraq is a US ally even though its neighbor is Iran. Saudi Arabia is a US ally, Israel is a US Ally. Iran’s ally is Russia but Trump and Russia are Frenemies. China is allied with Saudi Arabia and is trying to repair relations with the United States. The United States does not want to enter into another war because we literally don’t have the money, the country hasn’t been bringing in enough revenue (that big old budget deficit), and on top of that we were blowing money left and right on the previous wars. The worse thing that can happen is Iran shooting a nuke, but the nonproliferation treaty set Iran so far back in building nuclear weapons they’re starting from way far back and wouldn’t be able to successfully shoot one for a while. That’s why Trump talking so crazy. If Trump actually attacks Iranian monuments he’ll probably be labeled a war criminal and if Trump leads us to war, he’ll lose the 2020 election. The next President will likely sign a peace treaty and get us out of there. So whatever beef we have it’ll all be temporary. Focus on the money.

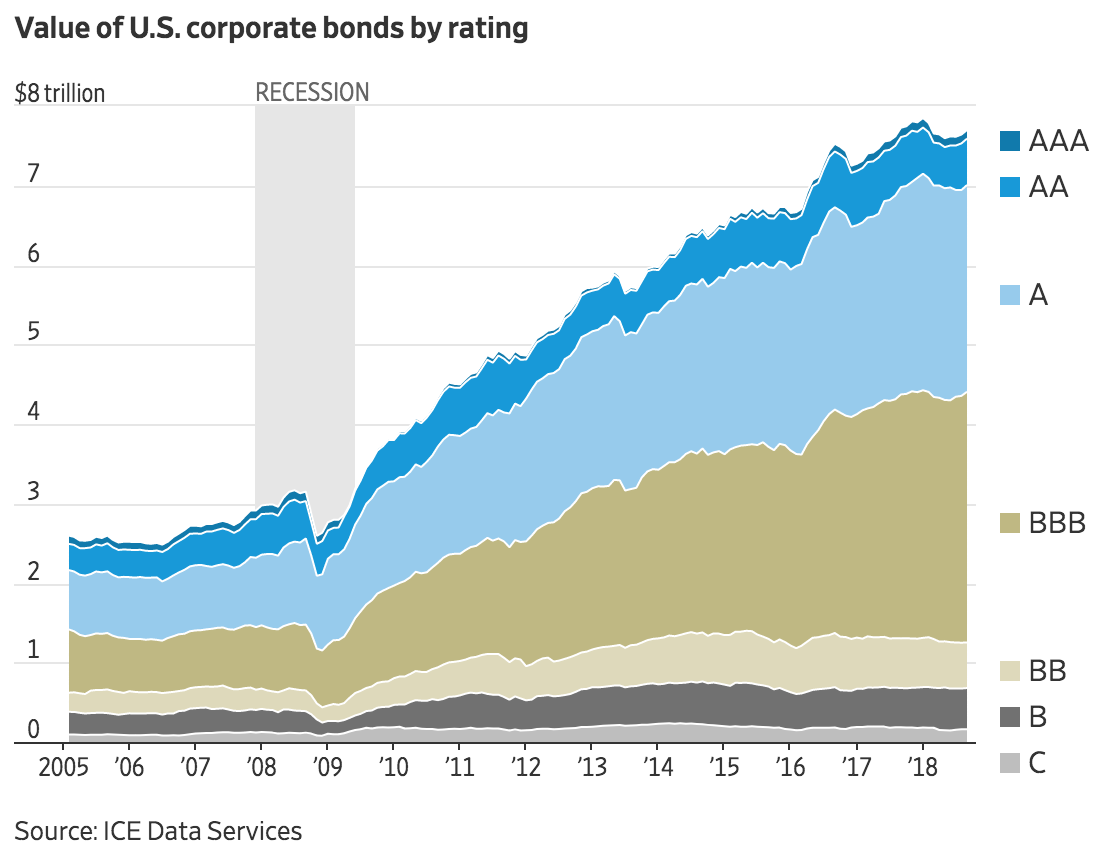

10. With that focus… This year in investing is about getting rid of the losers. The theme of this year is corporate debt and the companies with the highest amount of corporate debt will be the first ones to go into bankruptcy or get bought out. To be more specific, if you’re doing your own research look for which companies hold the most amount of BBB bond debt. Those are the bonds that I personally think are really junk bonds disguised as investment-grade bonds. Rating firms keep inflating bond ratings for the check. There’s no real article for this… This is just me coming to conclusions due to my own research. Also, this isn’t investment advice. Don’t forget that.

The Dime 1/7

MARKETS

1. Markets: Across the board markets ended lower due to the uncertainty with Iran. Today Iran actually fired rockets at US bases in Iraq so it makes sense that US markets are spooked. The Dow closed lower by about 119 points (-0.42%). The S&P 500 Closed lower about 9 points (-0.28%). The Nasdaq closed lower about 2.88 points (-0.03%). Crude oil is trading 2% higher at $64.10 a barrel which is what was expected due to the political pressure. I think we’re going to need to sit back a while and see how this unfolds because there alotttt going on right now in oil.

DEBT

2. In 2020 the first batch of companies to issue corporate bonds are US oil companies. They’re mostly issuing bonds so that they can have the cash to restructure their existing debt which they ran up during the shale (fracking oil) boom. They’re really pressed for money. North American Oil and gas companies have over $200 Billion worth of debt maturing in the next four years $40 billion of that maturing THIS YEAR. As I said, this year is about avoiding the losers. I’m not saying Oil and natural gas are losers, I’m just saying that when you owe money and borrow more money to pay off what you owe…. its not a combination that brings me joy.

3. So check it… Since we’re on the subject on bonds… I wanted to show y’all that we personally are not that far removed from bonds. See if you have a student loan, chances are that student loan has a bondholder. So when you decided to participate in forbearance, or defer your payments, or lower your payments, the bondholder is sad as hell lol. I read an article today that was interesting. There’s a woman who is 50 years old and owe $250k worth of student loans and pays the minimum because she’s on income-based repayment. It is estimated that the bondholder who backed her student loans won’t get paid until she is 114 years old. I think its safe to say that student loans are going to two places. Either the government paying for them, or a significant portion of people just ain’t gonna pay.

4. Speaking of student loans, things are getting wild with student enrollment in colleges. Falling enrollment is starting to shift the viability of investing in universities and the first batch of investments getting hit hard by it is investment in Student Housing. About 4% of debt backed by student housing that was converted into bonds sold in the market are 60 days late. Across the board that’s insanely HIGH. Bonds backed by apartments have 0.46% of them late or delinquent. What’s been happening is that there are fewer students but so many apartment complexes have been opening up, competition has become extremely fierce per student. If anyone you know is doing real estate and has a portfolio build on college housing… Check on them and see if they doing okay.

5. Due to the largest budget cut in probably a generation, the IRS personal income-tax audits have dropped to its lowest level in decades. Not even half a percent of all individuals who filed last year were audited. There’s just not enough staff to do it. So if you file your taxes this year, you’re half as likely as to get audited as you were 10 years ago. WILD. The audits have been down for 8 straight years. Right now the IRS has about 78,000 employees and what’s crazy is that about 31% are projected to retire within the next five years. That’s all I have to say about that.

FEDERAL RESERVE

6. The Federal Reserve hit the market with another $100 Billion today to keep the repo market afloat. $64 billion was used to buy overnight bonds and provide cash flow to money markets and another $35 billion is there to provide backup cash for the next 14 days. It’s crazy that this is happening because the Federal Reserve does not want to change one of its rules. This rule is called the Liquidity Coverage Ratio (or LCR) and essentially it requires banks to have a certain amount of cash at the federal reserve to prove that its solvent and safe. But this ratio is causing banks to actually not have enough money to fund daily operations, so instead of loosening the rule, The Federal reserve is like “Don’t worry fam I’ll just give you the money”. I’m not sure how productive this is…. but OK.

7. A Boeing 737 Passenger jet just crashed in Iran due to technical difficulties and now shit about to get hella spooking. First, BOEING STOCK MIGHT GET ITS FACE BEAT IN TOMORROW. Second, Iran gonna be in hot water because if this can be traced back to the activity they participated in today, it’s about to get real wild. Staying on top of this story y’all.

8. Gold is trading well since the Iran conflict started. It topped $1600 for the first time since summer. Due to harsh politics between the US and Iran investors are trying to park their money into safer investments. If you’re a subscriber of the Raising Benjamin Newsletter you probably got that Fire safe haven list I sent y’all over a year ago. If you’re in The Black List you probably have Gold in your portfolio. Gold is one of those assets that investors tend to run to when markets are choppy because it transcends any type of currency and all countries accept it. The issue with Gold of course is its portability.

9. Due to falling in-store sales Macy’s is reportedly closing more than a dozen stores. To add to that, Pier 1 Imports is closing up to 450 locations which are almost half of the stores they have open in general. Retail locations are getting ate alive by e-commerce (Amazon, shopify) and its only getting worse. It’s crazy watching these establishments that made up my childhood close like that.

10. California passed a new law (that just became active for this new year) called the California Consumer Privacy Act or the CCPA. This law gives residents of California the right to learn what data companies collect on them and how they make money off of that data. It also allows residents of California the right to ask companies to either delete their data, not sell it, or both. This is a big step in privacy and economics when it comes to tech. A big driver of tech companies is data and many of their valuations are based on the revenue that can be earned on data. It’s also ironic that California, home of Silicon Valley, passed this. I definitely can’t wait to see how this changes the tech landscape.

The Dime 1/8

MARKETS

1. Markets: Today was a decent day in markets relatively speaking. We bounced back from a few bad sessions due to the uncertainty of the Iran conflict. Trump out here talking like a WWE wrestler… So it’s lookin like investors are feeling the good buzz too. The Dow finished about 161 points higher (0.56%). The S&P 500 Closed about 15 points higher (0.49%). And The Nasdaq closed about 60 points higher (0.67%).

2. As expected (if you read yesterdays Dime you know what I mean) BOEING TRASHED IT today. The stock fell almost 2% on the news that a Boeing 737 crashed as it was leaving Iran for Ukraine and killed 170 people. Rest in peace to those who were lost and condolences to their families. Boeing has to get it together before no one on earth is going to want to fly on a plane that was made by them. Seriously.

3. To switch things to the opposite side of death, people are using technology to procreate. Nah literally. There are two apps out there that are currently helping strangers meet exclusively to have children. Not for love, just to have kids. The Apps are called PollenTree and Modamily. You create accounts on these apps with your preferences and about yourself and you are matched with a partner who is looking to have a child. I never thought we would have apps that would help strangers have babies together. Pollentree has contributed to an estimated 500 babies. That’s wild. The future is interesting.

4. MEXICO HAS OIL. According to a group of drilling companies that own the rights to drill in the area, The Zama field in the southern Gulf of Mexico likely contains 670 Million barrels of recoverable oil. The first production from the area is expected to happen within three years but things may take longer because you know… The Mexican Government gotta give the green light. Apparently the newly discovered oil is adjacent an oil field that is owned by Pemex (one of Mexico’s largest oil companies). This is the beginning of a long story that I can’t wait to see the movie about in like 10 years lmao. Oil markets aren’t shook though. It’s too early and the findings are too small to really have a dent right now.

5. McDonald’s is in trouble again. Recently their CEO had to step down because he had an inappropriate relationship with a colleague. Today two black executives sued the company for racial discrimination and civil rights abuses. The suit claims that people have been demoted both at the executive level and have dealt with hostile environments in franchises due to racial discrimination. The suit also claims that people have been repeatedly passed over for promotions and that the number of black people in leadership fell to 7 last year from 42 in 2014. Not gonna lie McDonald’s if this is true… I ain’t lovin’ it bro.

6. Another thing we ain’t loving is Samsung’s 34% expected drop in profit for the fourth quarter of 2019. WOW. Executives are saying that the drop comes from a global slump in semiconductor sales (the little chips you find in your phone) and that has caused the company’s failure to perform. What’s worse is operating profits (how much money a company generates from its core business) is also down $4 billion. The amount of revenue they made? Flat. Barely grew at all. Samsung is having a HORRIBLE quarter fam. This quarter by Samsung has me looking at the tech market in an interesting light because they’re literally in the thick of it. They’re the largest chipmaker, they also are top 5 in hardware, huge in mobile, but to be fair… the Trade war did get to them. Let’s see how well they perform in the upcoming quarters.

7. My favorite type of real estate investment is making a seriousssss comeback. Real Estate Investment Trusts (REIT’s for short) are starting to attract a larger number of investors and due to this these REIT’s are making some blockbuster deals. Now these REIT’s are a little different than the ones that I’m used to. The REIT’s I like are ones that are traded publicly in the markets, but these new REIT’s are called “Nontraded REIT’s” which means they are not as liquid (aka not as easy to get out of). Many people have criticism for these types of REIT’s saying that they’re just holding investor money and not really doing much with it… But Blackrock’s Nontraded REIT just landed a deal in Las Vegas that gives it control of the Bellagio. A few years ago Nontraded REIT’s had a bad year and investors lost faith in them. I’m interested to see what happens moving forward.

8. Cargill (one of the largest meat suppliers in the US) said that their poultry and beef operations have increased over 60% due to increase sales in China. Literally China is going after so many different types of meat to make up for their pork shortage (From African Swine Fever) that it is literally pushing up the prices of ALL MEAT. I wish I could add Cargill to my bet but they’re a private company. It’s crazy how hard African Swine Fever hit China man. I still believe this is going to be the biggest story of 2020. (I know y’all are tired of me talking about this but ITS A BIG DEAL).

9. Some investors are unclear about how to navigate the markets right now because we have a treasure trove of conflicting data. When it comes to consumer confidence most managers from big companies are worried about the economy but most people operating small businesses are actually very optimistic. The ISM numbers (essentially these are numbers that tell us how manufacturers are doing) haven’t been showing great results, but the flaw in ISM numbers is that they’re skewed toward larger companies because that’s who makes up a majority of their dataset. This difference in opinion has caused friction and confusion about how to move, how to invest, and more importantly… where to invest.

10. Luxury credit card companies are starting to raise fees on their credit cards. Amex is raising its fees (and its perks) and Chase Sapphire is raising its yearly fee to $550 (up from $450). They’re also adding more partners like Doordash and Lyft. New cardholders will pay the fee on January 12th and people who been had Chase Sapphire will pay the fee April 1st. It’s interesting to see credit card companies do this especially because competition is so fierce in the space. Amex and Chase Sapphire have been neck and neck in these streets really paving the way for how credit cards should be done. They’re the cream of the crop of credit cards right now. Their main strategy to get new customers is to target them by providing points/services that are popular. Amex increased their price but also added $200 for uber. These small changes (that come with rewards) keep people from leaving and at the same time keeps them using the cards. Clever business model y’all. Kudos.

The Dime 1/9

MARKETS

1. Markets hit alllll time highs AGAIN, with renewed faith that trade tensions will chill the fu*k out and possibilities of another semi-deal will push through. Next week China’s top trade negotiator is coming to Washington to rap with Trump about the possibilities that exist in ending this trade war. We already have Phase 1 coming together which is great let’s see what can come up next. The Dow closed about 211 points higher (0.74%), The S&P closed about 21 points higher (0.67%) and the Nasdaq closed about (0.81%).

2. Some wild shit happened today, a US Bankruptcy Judge excused a US Navy Veteran with a law degree from repaying over $220K worth of student loan debt. Yes, I said what I said. Lawyers holding it down for other lawyers. That’s what I like to see. Judge Cecelia G. Morris of Poughkeepsie, NY (the new patron saint I’m praying to) wiped away the debt even though the vet isn’t disabled, or unemployable by saying that paying off the debt would be an undue hardship. In her ruling, Judge Morris said that most people in the bankruptcy industry and ordinary Americans “believe it impossible to discharge student loans.” The test that bankruptcy courts use to establish undue hardship is called the “Brunner test” which establishes that borrowers looking for debt relief from Bankruptcy for their student loans show that they cannot maintain a standard of living and will continue that way if they show “good faith” in trying to pay the loans back. LORD, I’VE SEEN THE GOOD YOU’VE DONE FOR OTHERS, I JUST WANT THAT FOR ME.

3. So the other day I said that the Boeing 737 Jet that crashed leaving Iran happened due to “technical difficulties” and that I hoped it was only that because it would be big trouble for Iran. My hunch told me it was because of some other sh*t, and I’m sad because my hunch was right. Canadian and UK officials believe that the plane was actually shot down by the Iranians “by mistake”. This shit is wild as hell. I knew war crimes would come out of this because everyone was too upset and talking too much sh*t. Ego’s can get so crazy and now 176 people are dead including one of my peers from the World Economic Forum. It’s truly a sad day for the world. Someone gotta pay for all of this. For real.

4. The MTA has decided to remove 300 new subway cars from service due to safety issues with the subway car doors. It’s crazy because the MTA dropped $600 Million on these new subway cars and now they gotta replace them. In the meantime the MTA plans on swapping out the new cars with spare cars (OLD ASS SUBWAY CARS). Mind you the fares finna stay the same. Interestingly enough though, NYC has this new low-income subway program that lets people pay less for Metrocards if they make under a certain amount of money. If you’re signed up for texts from my assistant @raisebenjamin shoot a text asking for the MTA subway link and I’ll make sure he texts you the info.

5. Good news….. Fewer people are filing for unemployment. Jobless claims were down 9000 last week to 214,000 (nationwide) which either shows that people done found crazy side hustles or that the labor economy is doing well. Hopefully, it’s the latter. These numbers tend to be fickle though, sometimes people tend to file for unemployment later or wait for the severances to hit low numbers (or fully payout) before filing for unemployment. This could be a mix of those two factors. I tend to watch these numbers often so I’ll report back on a later date.

6. The US Population is growing at its slowest pace in 100 years. It’s mixed news for me, on one end it’s showing that either we not having enough sex/we’re wearing protection, or we’re just saddled with so much debt and fear of the world that we’re deciding to not have kids (or have less kids). This sounds like good news to some but in the future, we’re going to need people to help our country grow and on a more personal note… who the hell is going to pay my social security when it’s my turn to cash out????? Many of the issues that have led to the population drop are infertility (in men and women) and one of the other issues is falling immigration.

7. California is on a run. A new press release stated that the state is looking to launch its own prescription-drug label with generic drugs to aid in bringing down the cost of prescription drugs. I’m not going to lie… This is probably the best idea I’ve heard from a state in a while. Way to attack the problem head-on. The next step is to reform the Patent laws so that pharmaceutical companies can’t hold on to the exclusive rights to their meds as long. By bringing shortening the time allotted on those rights new drugs can become generic drugs at a faster pace, thus bringing down the overall price of prescription drugs (hopefully along with the rest of healthcare). Hit Benjamin if you want a text to learn how the prescription drug industry works.

8. A bunch of real estate startups are making it much much easier to purchase your first investment property (either in whole or in part). Specifically, a startup called Roofstock has created an online marketplace where buyers and sellers trade 500 rental homes a month in Atlanta, Indianapolis, and Houston. Most of the homes sell for prices going from $50k to $400k AND THEY COME WITH TENANTS. They essentially turnkey! Another startup that helps investors is called Compound, which allows investors to buy shares of condo’s for as little as $50. Investing in these types of products can increase your passive income and get you extra cash flow to invest in other things or just supplement your lifestyle. Get on it y’all. Let’s get this cheddar.

9. A new competitor to Beyond Meat just got funded. New Age Meats just raised $2.7 Million to make more Lab-grown meat to bring to market. The company was founded in 2018 and is developing pork sausages from animal cells.

10. The beef with Iran has made some positive waves in the markets. Cybersecurity stocks have been killin it in these streets since the beef popped off. Specifically, Three ETF’s have been wilding First Trust NASDAQ Cybersecurity ETF (CIBR), and ETFMG Prime Cyber Security ETF (HACK)… Both have been up over 2% in the last 3 days. I’m not telling you to buy those ETF’s I’m just saying… This is what the chart says.

The Dime 1/10

MARKETS

JOBS REPORT

2. The Monthly Jobs report came out today and we got some very interesting data. The economy added 145,000 jobs in the month of December which makes 10 straight years of job growth in our economy. I dead overheard someone on the train say “If you don’t have a job in this economy it’s your own damn fault.” I wouldn’t go that far but I guess I see the sentiment. This 10-year stretch is the longest stretch of job growth in 80 years which is very f*ckin impressive for an economy that was on life support in 2008. More Jobs talk in the next Dime tho.

3. So one interesting tidbit from the Jobs report that I caught is that women have finally become the majority of the workforce. I don’t want to start no drama but I think dates are going to get very awkward when the check comes around moving forward lol. Women are currently holding 50.04% of the jobs (not counting people who are self-employed). Women are taking most of the jobs in the sectors that are growing the fastest. We’re talking about healthcare and education mostly. In the next 10 years, I hope we’re seeing more women CEO’s and membership on boards. That would be fire. In December alone healthcare and education added 36,000 jobs. That’s hella nuts. Mind you, those jobs pay very very well. So fellas, if you’re thinking about a career change… I’d heavily consider Healthcare or education. I did a Raising Benjamin Newsletter on how to get a job in healthcare with a person who works in recruiting at a large healthcare provider so if you need tips DM or shoot me a text through the @raisebenjamin app for the link.

4. Speaking of getting paid more money, Taco Bell has decided to pilot a program where they’re going to pay their managers $100,000 a year. Yes. YOU READ THAT RIGHT. A WHOLE SIX FIGURE SALARY AT TACO BELL. Fam. Restaurants are pressed. Between rising meat prices and smaller margins, restaurants are relying on talent to take their services to the next level and it’s about time that they start paying their employees more. The fight for a $15 wage is just the beginning. Folks need to push higher. A service-based union would actually be really fire.

5. Someone is preparing for a recession and isn’t telling us because people are still buying municipal bonds like they going out of style. Municipal bonds had a monster year in 2019 to the point where the S&P municipal bond index rose over 7% which is the highest levels we’ve seen in a while (at least 10 years). Over $6 billion of Municipal bonds were bought in the last year due to tax changes made on the state level in high tax states like California, New York, and New Jersey. What most people don’t tell you is that literally all of the money you make on Municipal bonds are tax-free. Municipal bonds are bonds issued by your state and/or local government. That money is used to fund the building of roads, bridges, schools, or simply to pay for public services that people in your state need. Investors are taking advantage of this because even though the federal government has slowed the gas on high taxes, states have not. They’ve been collecting higher taxes from you, me, but most importantly really rich people. So instead of paying the taxes they rather invest the money, get paid in interest and pay no taxes on the interest they earn.

6. Over the last few days, the Federal Reserve dropped way over another $100 billion in cash to support the repo markets. I know I keep updating y’all on these numbers but it’s important because I haven’t seen the federal reserve pump this much money into an area of any economy since the financial crisis. I’m not saying this to scare you or anything but to me it’s weird. The FED is basically flying blind here because they never really had to deal with this type of problem on this type of scale. For those catching up, the Federal Reserve is basically running a repo program in which they are buying treasury bonds from banks and providing them with cash for it. Usually, banks/money market funds do that with each other. The issue is that money market funds/banks aren’t doing it because they don’t have enough cash on hand due to new federal reserve rules made after the financial crisis. I’m praying that pumping this much money on a regular basis is the proper solution because if it isn’t we might have a bigger problem on our hands.

IPOS (INITIAL PUBLIC OFFERINGS)

7. Casper, the mattress company, is launching its IPO soon. The company is currently valued at over $1 Billion and is generating over $300 million in revenue. That’s pretty good for a company that less than 7 years old. I’m not one to jump on IPO’s though simply because I need that public data to show me the real real. IPO’s, in general, had a hard time last year. Uber didn’t do so hot, neither did Lyft or Peloton. WeWork basically died during the IPO process and many startups took that as a warning to with things up and try to use another process of going public called the “direct listing”. Spotify did this and was successful, Google did something like this back in the day as well. Google’s version of this was called a dutch auction. Direct listings are essentially when a company decides not to issue new shares or work with underwriters (people who help promote and guarantee long term shareholders) to sell their stock on the day it goes public. People who had the stock before it went public tend to see the first day it trades to other people who are interested in gaining ownership in that company. Direct listings are of course slightly riskier but are way cheaper than the traditional IPO process when it requires you to pay people like Goldman Sachs large fees to bring you public. An IPO is like paying a party promoter to get you into a club so you can stunt in a bottle section. You get alotta shine and you might actually make some new lit friends but it’s going to cost you a pretty penny for the promoter.

8. This year is looking like a big year for dividend payouts. It’s projected that over $500 Billion worth of dividends are going to be paid out this year by companies. Most of this is because companies are filled with cash in their pockets, another reason is that if a recession comes around companies want to make sure that people hold on to their stock. Dividends are essentially a thank-you payment for owning a stock. I tend to look for high dividend stocks to fill my portfolio because I know I can have a nice stream of income on top of the growth I get from the stock increasing in value over time. The thing that sucks sometimes about dividends is that you have to pay taxes on that income so the way I try to avoid it is by using my dividend payments to reinvest in the company by buying more shares of stock. It’s completely legal and some people’s investment accounts actually do it automatically. It’s something you should consider. Remember this ain’t investment advice so don’t be walking around telling people I told you to reinvest your dividends. If anything just say I introduced you to it and you want to know what your options are.

SPOOKY MARKETS

9. Ironically in booming markets things can get…. interesting. Like this little tidbit. As the market sets new highs almost 40% of companies that are at record highs are actually in the red when you look closely at their books. That’s why people like me sometimes feel funny when seeing these numbers because they just don’t make sense. That’s why it makes even better sense to go bargain hunting to find good cheap stocks in companies with lots of revenue, low debt, and solid business models. Take Tesla for example. It is currently valued at over $85 billion, more than Ford and GM combined yet it didn’t turn a profit until the fourth quarter of 2019. How is a company that doesn’t make any money worth more than two companies who have long track records and steady sales and profits? I don’t know. I guess I gotta leave that to people who understand Tesla better than I do but I can’t front… The cars are fire.

10. ETF companies (outside of Blackrock and Vanguard) are having a bit of a problem. The problem is that their assets under management aren’t growing. What seems to happen in the industry is that many investors are directly investing in the larger names more so than the smaller ones which have removed the opportunity for smaller ones to make strategic investments to prove themselves. Only about 55-60% of ETF’s are actually making money. The rest are either not making money yet or are closing up shop altogether. For those who aren’t familiar ETF’s are short for Exchange Traded Funds which are investment vehicles that curate a list of stocks (or other assets) based on asset class or strategy. So if you wanted to invest in Gold you could invest in the GLD which is an ETF that is focused on investing directly in Gold Bars. Yeah. Literally the metal gold. Some other ETF’s like the XLF invest in a basket of bank stocks so you have a diversified investment in the financial industry by buying 1 asset instead of buying a share of each bank stock individually. There are positives and negatives to having large companies dominate the industry. The positive of course it’s that you the ETF you buy is from a more trusted name with a better track record. The negative, of course, is that your options are limited so you may actually be paying higher in ETF fees or just limited strategies and exposure because the same types of folks are trading the same types of assets in a similar way. It’s all a double-edged sword I guess.