We Been At ALL TIME HIGHS ALL WEEK

What’s good y’all. Here’s your edition of The Dime 💰Weekly. It’s literally each Dime you got this week. If there’s anything you missed or just want to look at again, it’s here. Remember, don’t be stingy with this, pass it to a friend. (All the market updates have been removed from these so you can have just the stories that interested you.)

The Dime💰1/13

1. The Jobs Report gave us some more interesting data when you look at it more closely. Over the past year wages for people over 25 years old without a high school degree grew over 6% and almost 4% for those over 25 years old who went to college but didn’t finish. This is great news because it shows conditions for those who opted out of a college degree are starting to see higher checks. Teenagers are also seeing a bump in wages since Trump has become president. During the first 11 quarters (essentially almost 3 years) since the Trump presidency the median wage for teenagers has increased over 5%. Now I personally don’t credit Trump for all of this. He inherited a pretty good economy and didn’t really have to do much to keep the ball rolling. To compare, it’s like your parents left you a heavy trust fund of $1 Million and you end up earning another $500k on top of it. Yeah you didn’t blow it, but we all know the first Million is the hardest.

2. Speaking of Jobs and creating them, many non-tech companies are ramping up their venture capital investments which really is a shining light for entrepreneurs because it looks like the investment opportunities are becoming more plentiful. Many non-tech companies out there are searching for tech solutions to bring their systems into the new century. By not innovating they risk losing their competitive edge to new startups (which we’ve already seen happen with old taxi cab companies and Uber/Lyft). I think if this continues and more large companies invest in startups we might be able to see a substantial transfer of wealth. This is the beginning of something very interesting y’all. In the last two years, there have been over 500 venture capital deals with at least one corporate sponsor funding it. The finesse is growing. For my entrepreneurs out there building businesses, keep working.

3. While we’re on the subject of large companies paying out large amounts of breaddddd, manufacturing companies are starting to significantly increase their perks to get people to move to where their factories are. In the last 70 years people have moved less. A person stays in their home for a little over 13 years on average today even though back in the day it used to be 8 years. Also, when you count for population density, more people have been moving to big cities and staying there instead of moving to suburban or rural areas (where the factories are). The biggest hurdle is that relocating is insanely expensive which causes people to chill out and stay where they are. So to deal with these issues Manufacturers are paying relocation costs and adding a bonus on top to get you to move. They need to because there are over 500k factory jobs simply left open which is the most in 20 years. On top of paying for relocation costs and bonuses some manufacturing companies are even doing signing bonuses (even for jobs that pay by the hour). It’s crazy to see this happen but also it makes sense because unemployment is hanging around its lowest level in 50 years. For those who live in the city and are looking for a good paying job that will pay you up front… It’s something you should consider.

4. New laws in the European Union have forced financial firms to have to buy investment research from investment research companies. Whether you know it or not, investment research costs a pretty penny and can range from $5000 for one stock to $25000 or more for research on an entire sector. Because of the price tag and forced the new law, hedge funds and other trading firms have just been making trades on less and less research. Analysts are actually covering less stocks in Europe or in some cases they’re not covering some stocks at all. What’s been happening is that many of these Hedge Funds have been building their own research divisions inside their firms to circumvent the law and pay less for actual research. This creates a small opportunity for folks, jobs. Although this hurts the bottom line for banks in Europe, it definitely helps young grads who are looking to break into the industry and earn them some checks. From a market perspective though, lower research leads to less money for investment in a particular stock. This leads to larger price swings because people are either trading on geopolitical news or earnings reports on a stock. So if you’re an individual investor, you essentially have to pay for expert research or learn intimately about every single stock and industry on your own if you want to compete in the markets.

5. So the economic numbers are finally starting to settle in. It’s not official and its wayyyyy too early to tell but its looking like the Trade War with China didn’t have a LARGE effect on the US economy. Don’t say this to a farmer though, they might punch you in the face. Farmers were the ones who took the hardest hit because in some cases China is their largest, second-largest, or third largest client. The reason we didn’t feel it as much is that farming is a smaller portion of our economy and farming jobs only count for 2% of the US economy. Carmakers, furniture makers, and machine makers also got snuffed due to the Trade War. All of this caused their items for sale to cost about 3% more in the last two years. Farmers, on the other hand, lost $28 Billion in exports to China because of the war. Farmers had to borrow a shit ton of money and some of them even went bankrupt.

6. Due to rising push back from ALL OF US. Drugmakers are trying to figure out a new way to get paid. Instead of charging super high prices for access to medicines when someone is sick they are starting to rely on patient data to alter their pay models (so now it makes sense why Google went into the medical data business). Drugmakers are tying installment plans, subscriptions and value-based contracts that are tied to how much a drug helps a patient instead of the traditional “pay a brolic ass price for this drug or don’t get it”. Even though these models don’t lower the price of drugs but at least they’ll make them easier to pay for? I’m not sure how I feel about it yet so I’ll wait until these come to effect and see how it affects patients.

7. While we’re on the subject of human science, some Genetic databases (NOT 23andMe or ANCESTRY.COM) have been sharing their genetic data with law enforcement and they’ve been using that data to solve crimes. Third-party sites like GEDmatch and FamilyTreeDNA have been opening up their genetic data to law enforcement and companies like DNASolves have been actively creating portals to help cops. What’s even more interesting is that crimes have been solved using this data. An old case of 13 murders out in California was solved using DNA data from GEDmatch. To learn more about how these companies have been using your data (for law enforcement and otherwise) DM me or head over to @djsquared’s page and peep her TED Talk on the matter. If you’re out here doing some funny shit or committing crimes, you might not want to go looking for your family history dawg.

8. On January 1st, 2020 New York State’s bail reform came to effect. For those that aren’t familiar, most misdemeanors and most non-violent crimes have NO MORE BAIL attached to them. You get arrested, get processed, get a court date, and go home. This has been a subject of large debate in Albany and although Democrats overwhelmingly passed this law last year, some of them are starting to think…. maybe they went a little too far. Because of this some democrats are bringing amendments of the bill to the floor. Some of these amendments include attaching bail to hate crimes at any level, allowing judges to set bail based on how dangerous a criminal defendant is to their community, sex offenses, and drug sales (currently none of these crimes have bail set on them at the moment).

9. Tackling homelessness in New York City has encountered a new problem. Figuring out where the homeless can live. New York City tried a program where they would send people (those who qualified) from New York City to apartments out in Newark, NJ. Newark found out, got mad, passed a law to block the program, and sued the living hell out of New York City in Federal Court. Some people have reported that the relocated apartments have horrible conditions, they’re rodent-infested, there’s no heat or electricity and what’s worse is some New York City employees didn’t even inspect the apartments before placing people in them. Since then, the program has stopped. But now a new problem arises. A woman who is a domestic violence victim is saying that the Newark law blocking her from moving actually puts her life at risk because it’s easier for her abuser to find her if she is still in New York City. This entire ordeal really puts a spotlight on how complicated homelessness is to tackle.

The Dime💰1/14

1. Does it feel like the prices of items you’re buying are going up? That’s because they are fam. US Consumer inflation rose 2.3% to cap off the year 2019 which is up 0.4% from 1.9% the year before (2018). That means the price for some of the items you bought in the last year went up over 2%. We’re talking about food, dental care etc. What’s crazier is that on average prices for shelter (rent and home prices) went up 3.2%, as if the paying for the crib wasn’t high enough already. Make sure you’re saving a little more for those price increases coming 2020 and more importantly make sure you mention this when it comes to your salary increases in the coming months. Companies be acting funny when it comes to paying more money but once you hit them with the “inflation was 2.3% last year… why are you giving me only a 2% raise… That’s less than inflation>” then the conversation gets… a… little…… DIFFERENT. A big reason why inflation increased at a faster rate in 2019 is that the Federal Reserve cut interest rates THREE TIMES. Cutting interest rates makes it cheaper to borrow money which by default adds more money to our financial system. The more money we add to our financial system the more money we have to buy the same or fewer items available, so that puts businesses in the prime position to raise their prices since they know we have the money to pay it.

2. While on the subject of the Federal Reserve. The Federal Reserve (or the FED for short) added another $82 Billion to financial markets to continue their REPO operations (after adding over $100 billion last week). REPO is short for Repurchase agreements which money market firms and banks use to provide cash to each other. Here’s how it works… One person (let’s say a bank for this example) has treasury bonds but needs cash so that when you go to the ATM money will be there to come out. Another person wants to make interest off of the fact that the other person (the bank) needs cash. The bank will borrow cash from the other person and use the treasury bonds for collateral. These loans are usually done overnight and paid back the next day (or in a few days/weeks). REPOs are the backbone of our financial system because they allow banks to meet their regulatory requirements or simply just have enough cash to give us our money if/when we need it. It’s important to keep tabs on this because right now banks and money market dealers usually do these transactions with each other but have been charging way higher interest rates than the Federal Reserve wants because they are each short on cash. So now the Federal Reserve has to step in and provide that cash. They’ve been doing this heavy-handedly since September. Keep your eyes on this y’all.

3. If y’all have been flying Delta… Delta thanks you. Delta’s stock is up over 3% today because it just hit its 10th straight year of profit in the last quarter. That’s actually VERY impressive for an airline business. Historically airline businesses have been wishy-washy due to federal regulations, plane crashes and jet fuel prices. After analysis of what caused the profit, it was Y’ALL buying all these tickets to fly and visit friends and low oil prices which really helped their bottom line. Imagine not only keeping/increasing your sales but at the same time paying less money for your supply? DELTA IS HAVING THE TIME OF THEIR LIVES. Shoutout to those who own Delta stock. Bottles on you.

4. Speaking of profitable quarters, my homies at JPMorgan are having a field day too. The company reported a 9% increase in revenue and was able to dish out a profit of over $8 Billion. A strong economy has led to an increase in Mergers and Acquisitions which has helped JPMorgan’s investment banking unit. Every time you hear about a company getting bought, sold or merging, usually investment bankers have a hand in that deal helping spearhead the process. Usually, both the buy and the seller hires an investment bank to guide them through the deal to make sure that they’re getting a fair price. Investment bankers also help bring companies public (doing IPO’s). Since we’ve been seeing a lot of that lately it makes sense that JPMorgan (the country’s biggest bank) has been seeing their fair share of the action. I’m so mad that they’re having this much fun without me. Do y’all even miss me at all?

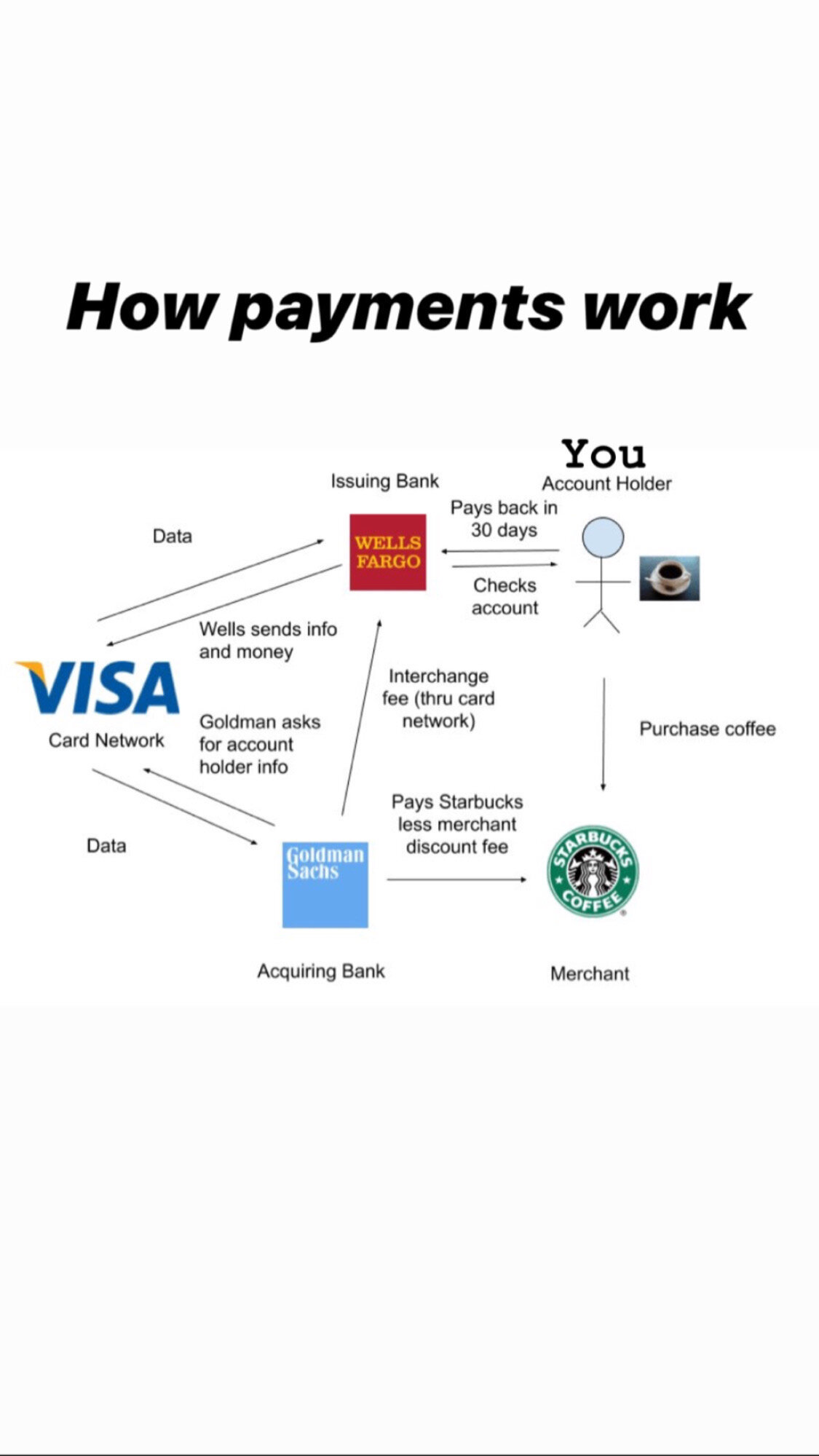

5. Since we’re on the subject of companies buying companies I just wanna let y’all know that Visa bought Plaid yesterday for $3.8 Billion in what is probably one of the most important internet deals in a long f*cking time. I like Plaid because it was a low-key big player that’s in everyone’s face but we don’t realize it. Plaid is the company that allows you to connect your banking information to any app. When you’re able to automate transactions because your bank is connected (through you entering your banking username and password) Plaid is the company that makes that possible. Plaid is one of the most important companies when it comes to facilitating payments on the web and now the world’s Payment GIANT Visa has just bought them. VISA JUST GOT THE LAST INFINITY STONE. For y’all that don’t understand how Visa’s business works, I’m going to break it down. Visa charges every merchant (a person who sells things) a fee for a transaction. They are the payment superhighway and they get a percentage of each transaction. The percentages vary but it can be around 2% per transaction sometimes. This is why every damn card either has Visa, Mastercard, American Express, or Discover. They are the MOB when it comes to payments. To get a better understanding of how payments work peep the next story.

6. Prepare for more environmental sustainability ETF’s because they coming. Blackrock (the world’s largest asset management firm) has decided to put climate change at the forefront of its decision-making. They’ve decided that they would be more critical of companies in how they handle environmental sustainability. They’re also going to be critical of them if they’re failing to report their climate effect numbers accurately. On top of that they’re going to lower their investments in coal producers and double the amount of ETF’s that address environmental, social, and governance problems. If these moves are going down, this will affect markets in a big way. This also creates an investment roadway for companies who have a focus on positive social or environmental impact so if you’re in that business keep your eyes open for more $$$ on the way.

7. People just ain’t taking the bus anymore because it’s too expensive and cities are finally getting the message. Cities like Lawrence, Massachusetts have decided to make riding the bus completely free (for two years) for some routes. After making them free they saw a 24% spike in ridership. Other cities are debating the free ridership model such as Olympia, Washington, Kansas City, Missouri, and Boston. Let’s hope this catches on and reaches New York. I’ve been requesting free fares for years and instead of raising taxes across the board to cover the cost. I personally don’t believe public transportation should be something that the public pays for.

8. Whoever owns Boeing stock… I’m sorry for you bro. Orders for Boeing have fallen to only 380 jets which is the lowest in 16 years. The brand got beat bad this year due to them rushing the 737 max process and the planes crashing due to it. To add insult to injury things got worse when it was discovered that they were deceiving regulators after spending so many years earning their trust. The stock has been paying for it in a brutal way. In the last year, the stock had reached as high as $446 a share and now it’s trading at the $330 range which is crazy. They just hired a new CEO so hopefully, things can change in the future and that can drive the stock price up.

9. The Amazon and FedEx beef is finally over. Amazon has lifted its ban on FedEx Ground shipping for Prime shipments. The ban has existed for a month after Amazon felt unsatisfied with FedEx’s delivery times (and possibly testing out its own delivery service as well) and FedEx’s stock took a beatingggggg. Right now FedEx stock is up above 2% since the news dropped and hopefully, it can pick up some more. This makes me worry about Amazon a little. Did they decide this because of the hurdles they’ve dealt with in building out a delivery business? Who knows. Hopefully, we’ll find out soon.

The Dime💰1/15

1. So what does the trade deal entail so far? Over the next two years, China has agreed that it will increase US imports by $200 Billion. These purchases will be in Manufactured goods, energy, services, and agriculture. China will also give the United States more access to its financial system (new investment opportunities are coming y’all) and will also provide more intellectual property protections for American Companies (less fake Apple products floating around China hopefully). Farmers are OD lit out this deal. They have been getting fried since the trade deal started and I know every damn farmer lookin at the TV like “It’s about time.”

2. In other news… Target isn’t providing good news right now. The holiday season was just not good to them AT ALL. They sold fewer toys and electronics during the holiday season which to me shows a bigger issue. The US Consumer just didn’t buy toys and electronics from them. The true numbers for me are coming from Amazon, if Amazon killed it in sales then I know where Targets money went which means Target has an even bigger problem. Much of my analysis on this comes from the fact that Target’s online sales rose 19% this holiday season which tells me consumers bought their shit online instead of in-store which means there’s a possibility that they didn’t find a deal they liked on Target and decided to type in Amazon.com and spend their money there. I don’t wanna get too ahead of myself though. All in all, shares fell over 6.5% today on the bad news. I also think investors overreacted so I’ll look deeper into the price to see if there’s a buying opportunity.

3. Remember the Goldman Sachs Malaysia scandal I told y’all about? Well, the total cost of that debacle finally came out in their earnings report and their profit fell like hell due to the legal costs of fighting the issue (gotta always be ready to take L’s off them Lawyers fees). The debacle cost them 13% of their 2019 profits (JESUS). Mind you they put away an extra $1 Billion to pay to settle the legal case with regulators. On top of that, they’re still negotiating with the US Department of Justice to plead guilty and settle on another $2 billion fine for violating anti-bribery laws. Looks like the Goldman Sachs CEO is going to have to do more overnight DJ gigs to make up for that loss because dawg this is nuts. Fundamentally though, the company had a decent 4th quarter. The investment bank had their second-best quarter in the history of the firm and their bond trading desk is actually improving. When you count in the fees for the fourth quarter though their profit fell 24%. The game is cold but Goldman finna stay on they grind.

4. Important news has to do with money but ain’t really money for real: 2019 was the second-hottest year in history. Ice caps are melting like ice cream in the middle of the summer y’all. I like wearing my jacket open in January and dressing fly as hell but I’m not sure if the price I want to pay for that is my life or y’all’s lives. Anti-climate change folks can talk all they want, this shit is real. To add to that, 10 of the hottest years on record have been in the last decade. This is data coming from NASA and the National Oceanic and Atmospheric Administration. They have been tracking this shit since 1880. So just remember, just because it’s snowing outside your crib, doesn’t mean the world ain’t getting hotter.

5. The President of the Federal Reserve Bank of Dallas (Robert Kaplan) issued a warning to us all. That the Federal Reserve pumping all that money every day into the financial markets is actually driving up risk-taking. This is a day after the New York Federal Reserve announced that it would possibly look into lending money directly to hedge funds for their Repo operations (the stuff I keep talking about every day). It’s about time someone spoke out on this because the Federal Reserve has been giving out money to banks and money market dealers everyday like the shit is fun coupons and it had me worried. Maybe it isssss time to worry a little. Now he’s not saying the Federal Reserve is doing a bad job, he’s just saying all this money might cause money market managers, hedge funds, banks, and other investors to take on higher amounts of risk because they know they have unlimited access to cash since the Federal Reserve wanna lend money out to people like they the Oprah giving out free cars (you get a loan, you get a loan, YOU GET A LOAN!). Stay tuned y’all, because once one Federal Reserve President publicly says something another Federal Reserve claps back and I’m here for ALL OF THE DRAMA.

6. US Producer prices issued their December report and prices are pushing higher (shoutout to inflation, I hate her sometimes I swear). The Department of Labor on a monthly basis produces a report called the “Producer-Price index” which measures the prices businesses get for their products or the services they provide. For the month of December is was up 0.1% from the month of November. Now when you look at the data from a yearly perspective business prices are up 1.3% which is 1% below inflation (2.3%) which is pretty decent since it’s not in lock-step but still gets me annoyed because as our money is becoming less valuable everything is still 1% more expensive than it was before. A lot of people are still digging themselves out of student debt we don’t need no damn inflation making the rest of our lives hard as hell.

7. If you live in New York Public Housing you probably realized something, there are less heating outages. Part of that is because this winter hasn’t been as cold as we expected it to be, but the other part is that NYCHA is trying. They’ve really been doubling their efforts in focusing on heat repairs and installing new technology to alert them if there is some sort of outage. Now this didn’t come out of the goodness of their hearts. The federal government actually mandated a maintenance plan and made sure that they followed it. This is coming as part of a settlement from a federal lawsuit that found that NYCHA wasn’t providing adequate heat in the first place and that they didn’t comply with federal regulations to protect kids from lead paint/poisoning in the the NYCHA developments.

8. Something cool is happening in New Jersey. Governor Murphy is working to train more New Jersey residents for High Tech Jobs (cheaper rent and job training? Shit I might move.). A new workforce development program by the New Jersey Governor has a goal of increasing the amount of workers in computer science and tech jobs for 2020 and beyond. His goal is to increase it by at least 10%. The Workforce plan is going to focus on Post-Secondary (college) students which is about 500,000 people in New Jersey which should help a lot since historically New Jersey has been a great state for both jobs and schools. Let’s see if this can be successful.

9. Heart disease is making a comeback. Younger people, more middle aged people, women and nonsmokers have been reported to have more strokes and heart attacks in recent years. This baffles me because everybody and they mother literally working out on instagram. Most of this is being driven by obesity and diabetes. In the year 2000 there were almost 800,000 deaths caused by heart disease which went down to about 600,000 deaths in 2009-2010 but now is shooting back up to about 650,000 going into 2020. Almost 40% of adults over 20 are obese and another 32% are overweight. To add to that 9.4% of people over 18 in the US have diabetes. Research in these areas used to be a top priority but then things slowed down of course because the deaths slowed down. I’m hoping this data pushes more doctors to jump back into this research and provide solutions to both the overall health community and us cause I’m not trying to see me or the homies fall victim to a stroke or heart attack or any cardiovascular issue at that.

The Dime💰1/16

1. Big News: Alphabet (Google’s parent company) just became the fourth US company to reach combined value of $1 Trillion. THATS HUGE YALL. The Fact that we have four companies reaching $1 Trillion in valuation is crazy. Four companies valued at a Trillion dollars is Four Trillion which in perspective is nuts because our entire US economy is worth $45 Trillion so four companies together is almost 10% of the entire US economy. That’s power. The other three of course are Microsoft, Apple, and Amazon. This is incredible in many ways yo.

2. Speaking of big tech companies…. Facebook has decided to take a step back from selling advertising on WhatsApp. People have been upset about this move for a while and i’m glad that facebook listened. This was such a big deal that the actual creators of WhatApp left facebook. I’m guessing it’s a little late for Mark Zuckerberg to apologize but whatever. I understand why facebook wants to monetize though, they bought WhatsApp for $22 Billion… What did you expect? For it to not make money???? Facebook has decided to pivot to trying monetize off of enabling payments on the site and charging a small fee for the payment transactions. This is a pivot for facebook because Advertising counted for about 98% of its revenue in the third quarter of 2019.

3. Fiat Chrysler & Foxconn are teaming up to make a big splash in the electric vehicle industry. They not only want to produces electric vehicles but they also want to make a move into internet-connected vehicles. The split between Foxconn and Fiat will be 40/60 (40% for Foxconn and 60% for Fiat). For those who don’t know, Fiat Chrysler owns Jeep (the Wranglers & Cherokees) so it’s going to be interesting to see how these new vehicles will be in the future. Fiat’s focus is China right now but I wouldn’t be surprised if moves were made for the American market as well.

4. Since we’re on the subject of transportation, a Federal Judge blocked a part of California’s new Gig Economy law. The portion of the law the judge blocked surrounds the enforcement of the law on truckers. The issue here is that the California law can be pre-empted by the Federal Aviation Administration Authorization Act. Pre-emption is the federal governments ability to essentially over power a states rule due to the fact that a federal law exists to regulate it. The federal government has the option to pre-empt a state law. For example, if the federal government regulates censorship on TV and a state makes a law on censorship, the federal government can oppose the states law since the federal government already regulates it. It’s like when the CEO of a company makes a rule and your boss makes another rule that opposes the CEO’s rule, the CEO can come to your boss and be like “Nah fam, I got this. I’m the big dawg.”

5. The United States Treasury will issue new 20 year treasury bonds during the first half of this year. Usually the Treasury bonds issued are ones below 1 year (Treasury bills) and the 2 year, 3 year, 7 year and 10 year bond. When the US Treasury issues a bond of this length it’s because the federal government needs long term money. The last decade there’s been a bunch of bonds issued 10 years and below but because of this it has pushed the interest rates for short term bonds up and the interest rates of long term bonds down. Because of this it has been more advantageous to invest in the government (Buy Treasury Bonds) for the short term instead of the long term. This is the first time that the US Treasury is reintroducing a bond into the market since 1986. So this is very very serious and the Federal Government really needs this long term bread.

6. A real estate investment group named Harbor Group just did a $1.85 Billion deal to buy over 13,000 apartments across the south and midwest. Some states in that portfolio are Georgia, Texas, Colorado, Missouri and Texas. The average monthly rents in the apartments are $1010 a month and 95% of the apartments are ALREADY OCCUPIED. Think about this… the monthly rent on this deal is $12,473,500 A MONTH. That shit is bonkers. Shoutout to them. I hope the rental markets stay healthy so they can see their way through. A move like this inspires me to figure out new ways to get into the rental game but with an even lower amount of risk. Soon i’ll be writing a newsletter about getting into a real estate investing from the apartment perspective so hit the link in my bio and sign up for the newsletter if you’re interested.

7. Speaking of rentals, strip malls have been suffering the last few years due to the fact that many department & retail stores have been closing but there is a small light in the tunnel….. More community centered companies. Strip centers have been flourishing due to Grocery stores, convenience stores, and nail salons. The positioning is called “Grocery Store anchored” strip malls. You give a large amount of retail space to a big grocery store chain and allow complimentary businesses to open near them. The prices of Strip mall centered REIT’s (Real Estate Investment Trusts) have increased over 8% in the last year. Now of course it’s not huge in comparison to the rest of the market but it’s still progress compared to how they got their teeth punched in during other years. Let’s hope that activity can continue to grow in 2020.

8. People always thought that after a certain age you wouldn’t qualify for a mortgage and now that old adage is starting to shift. Banks are starting to give more mortgages to retirees who have fixed incomes from their pensions or 401k’s. A federal law has banned discrimination of mortgages based on age (The Equal Credit Opportunity Act) and banks are starting to really ramp up their lending to retirees. Banks are allowing retirees to use their investment portfolios as collateral along with other assets. Now I don’t know how I feel about it because gaining income in that age group is difficult but there is are a few bright spots. One bright spot is that less retirees will end up alone in nursing homes and closer to places they are more familiar with (especially with visiting home nursing services). Another bright spot and a slight bump in generational wealth. Because retirees are older in age they will have more assets to pass down to their children (and grandchildren) when the die. Do I think a retiree should get a mortgage? The answer is…. it depends.

9. Trades of ADR’s (American Depository Receipts) spiked in the markets today. American Depository Receipts are essentially the American version of a stock in another country. For example if a company in Brazil wants American investors to invest in them using American dollars in American markets they can issue an ADR. The S&P/BNY Mellon index (which measures ADR’s) rose 0.3% just today. The European, Asian, and Latin American indexes all rose by the same percentage. Either this was a small group of traders or hella investors are flocking toward investing overseas. If the latter is true, it looks like investors are seeing higher growth overseas. I’m going to keep tracking this activity to see if this trend continues.

The Dime💰1/17

1. Although we have hella confidence we do have some areas that may make me feel a little worried. For example, the number of job openings fell by 10.8% between November 2018 and November 2019 which tells me that employers are starting to scale back (or at least reconsider) the amount of staff that they need. Usually when job openings fall that means that job seekers have less leverage because there are less available jobs for them to choose from. So naturally with less available jobs, salary negotiations tend to change and companies start to have more of the upper hand. Even though we’ve had this drop in job openings the economy still seems to look good but I’d like to see the amount of openings pick back up so workers can negotiate higher salaries or have more job options.

2. The prices of wheat are up 25% from September. Crazy right? Well that’s because farmers haven’t planted this little wheat in more that 100 years. Some of this is due to the fact that Russia has become the worlds most dominant wheat supplier period. Because of Russia’s dominance farmers have decided to pivot to Corn and Soybeans (they’re more profitable) which leads to less wheat planted thus….. a higher price for wheat. Another reason for higher priced wheat is because Australia has been dealing with both a drought and wildfires which has limited their ability to even participate in selling wheat in markets. Weather also played a huge role in the decrease in amount of wheat plantings. So if you’re at the super market and wheat bread isn’t 2 for 5 anymore? You know its because the wheat markets gettin hit hard right now.

3. The United States Attorney General William Barr is putting pressure on Apple to unlock the phones of people who are under investigation/are arrested by law enforcement. Apple has not only made it difficult to unlock them but has actually added extra privacy protections (such as encryption) to their phones so that law enforcement has an even more difficult time in unlocking phones. Law enforcement states that the difficulty of unlocking these phones is extending cases such as child sex abuse and terrorism. He not only pressed Apple but he pressed Facebook too. If y’all out here doing funny sh*t, keep your phones out of it fam.

4. If you were considering visiting Cuba, you better do it fast. The State Department in Washington stated that public charter flights are suspended from nine Cuban airports. Public charter flights are still permitted to land in Havana though. The reason behind this is that the Trump Administration believes that Cuba is using some of its revenue to fund Venezuelan President Nicholas Maduro (who the US isn’t really feeling right now). Limiting the amount of charter flights to Cuba they feel would lower their revenue. What I do know is that flights to Havana are about to skyrocket because now it’s one of the only entry points to Cuba. So if you’ve been thinking about it… I’d recommend putting it on high priority.

5. China’s economy is slowing. In 2019 the economy grew by 6.1% which is the lowest it’s grown in almost 30 years. Wild right? Much of this has been caused by the trade war but also other issues such as low birth rates, a debt filled real estate market which hasn’t seen a huge amount of revenue yet, and consumers are also starting to spend less money period. Although these issues exist certain areas are still bright for Chinese investment. Pharma products, new technology, cars, and food are areas where you can really get some cheddar if you’re expanding out to China. Economists are projecting an even lower growth rate for China in 2020 (6% flat) but that doesn’t mean money can’t be made there.

6. The USDA is rolling back Michelle Obama’s favorite lunch policies and are now relaxing the rules which may lead kids to choosing less healthy meals (like pizza and burgers) over healthy ones. The Obama rules prioritized having a vegetable heavy meal selection at schools and less saturated fats, sodium, and milk products. The rules were originally set in place to reduce childhood obesity. I bet food companies are happy as hell that these rules are being relaxed. According to their data the USDA states that 31% of vegetables served in the school year of 2014-2015 were wasted and they want schools to have a wider variety of foods so that less food is wasted.

7. Spotify is in early talks to buy “The Ringer” which is super popular media website started by former ESPN commentator Bill Simmons. With their big shift into podcasting it makes sense to buy The Ringer because that media site has over 30 podcasts. This would really get things lit for Spotify when it comes to sports audio. It’s still too early to know if the deal is going to go through but to provide some insight Spotify spent $400 Million last year to cop three podcast companies and snatch up over 20 deals for exclusive or original content. Spotify making moves and coming for Apple. Apple dead better watch they back lol.

8. Midsize tech firms are starting to speak out and are telling lawmakers that Google, Amazon, and Apple are making it difficult to compete in the market. Sonos, PopSockets, Basecamp, and Tile Inc have told an antitrust subcommittee that Google, Amazon, and Apple use different strategies to beat back efforts of tech companies that enter their space. They stated that these companies have become gatekeepers in the internet space and will limit your ability to make money if you step foot on their turf. This is a big statement because the Antitrust department of the Federal Government has been working on building cases to limit the size of Google, Amazon, Apple and Facebook. It’s going to be interesting to see how this beef develops.

9. The Electoral College is being challenged in the Supreme Court in two different cases and things are gonna get spicy. The Supreme Court is about to consider whether presidential electors can vote for a candidate that has not won a states popular vote. Many of us know that President Trump didn’t win the popular vote but became President by winning the electoral college. For those who don’t know how the electoral college works, essentially every state has a number of “electors”. We usually don’t know who these people are and they usually are based with a party (usually the states major party). Even if the majority of the population in a state votes for one candidate, if the electors vote for another candidate then the electoral college points go to that candidate. You can’t win the presidency without winning the electoral college. Some states (Colorado) have issued state laws that automatically give all of the states electoral college votes to the winner of the popular vote. The decision of the Supreme Court on these cases can drastically take away power from the electoral college (or even functionally render them useless).

That’s it for this week’s edition of The Dime💰 Weekly. Don’t be stingy with the 🏀, pass it to a friend. See you tomorrow.