Janet Yellen. Former Head of The Federal Reserve. I miss her 😔

I want to start this post off by apologizing. I’m sorry that this post is going to be a flashback to 4th-grade social studies. It’s necessary. Not because we never learned the material, but because we have to view something that makes us upset from the context of 4th-grade social studies.

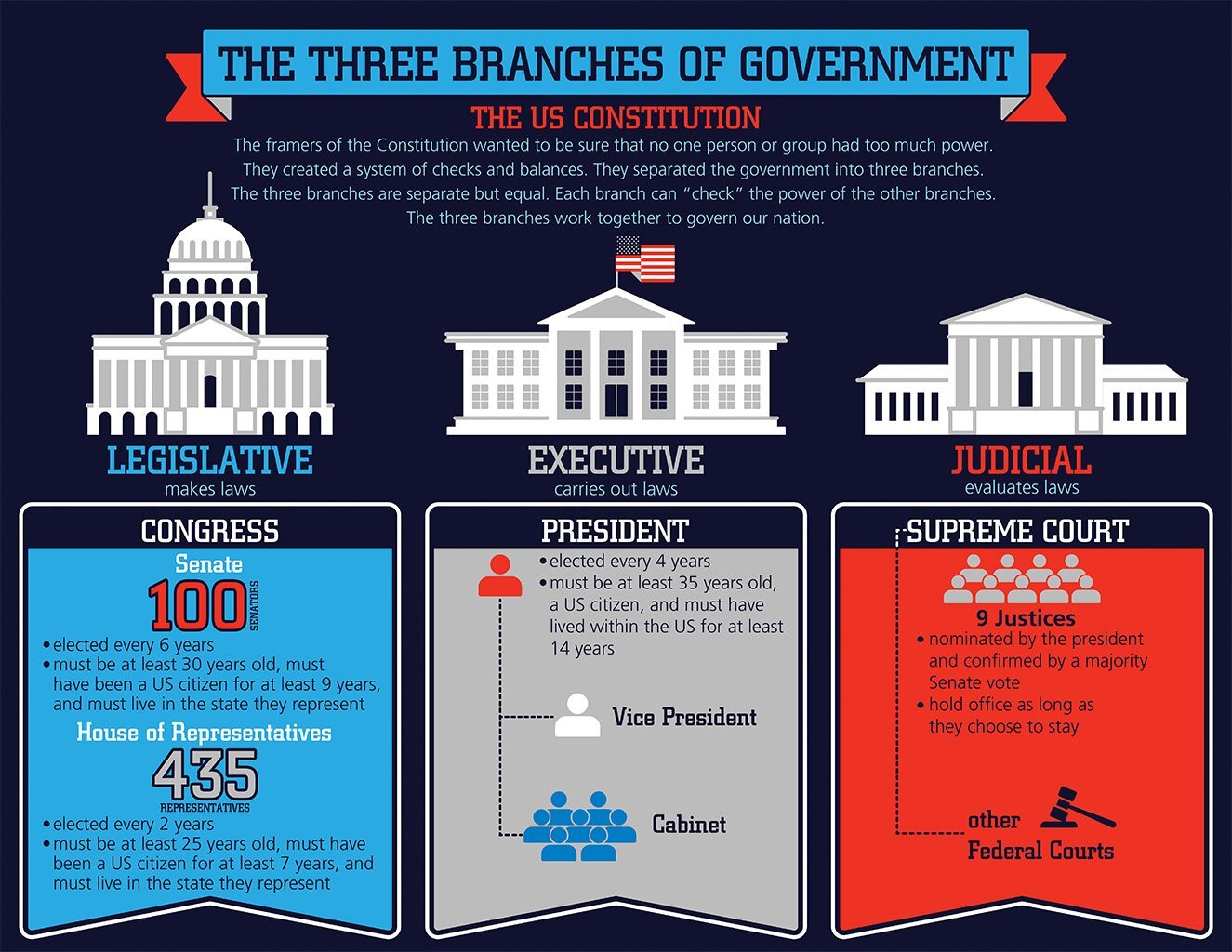

If you attended 4th-grade social studies in New York State it was probably your first brush with the three branches of government. The legislative branch, the executive branch, and the judicial branch. You were probably taught that the legislative branch makes and votes on the laws, the executive executes the laws by signing it into law and promising to execute them, and the judicial branch interprets the laws and declares them constitutional or unconstitutional. The basic premise here is that one particular branch of government can’t do another branch of government’s job. Congress can’t execute laws or interpret laws, the President (the executive) can’t write laws or interpret them, the Judges can’t write laws or execute them. Well in finance we have the same thing.

The Treasury Department is an arm of the executive branch. Its job is to manage government revenue, collect taxes, and police the actions of money. That’s why the logo of the Treasury Department looks like a damn police badge. As part of its job of managing government revenue, the Treasury Department has the power to issue bonds. These are called Treasury Bonds. The Treasury Department issues these bonds when the government needs money. The government may need money to pay for the execution of a new law that was written and passed by Congress (the legislative branch) and signed by the President (the executive branch). When the Treasury Department wants to borrow, they need investors to provide them with cash. Those investors can be you and me, or they can be other countries (like China), they can be anyone who believes that the United States will be better in the future and wants to invest in it. It’s important that you stick with me because the information I’ve provided so far is going to be very important for understanding what’s to come.

Historically, every country has had a weird relationship with banks. You can read as far back as the Torah or the Old Testament Bible, that people hated banks (or bankers). Usury was made illegal (and immoral), people hated tax and debt collectors, people hated going to debtors prisons, people always hated paying interest. The United States is no different. When you have a country as large as ours and you have a system of money (or anything else of value) you’re going to need a banking system. Banking is a practice that has existed since the beginning of time. When you have many banks across a large area it is likely that interest rates will be significantly different because of a number of reasons.

1. The population is different based by region.

2. The incomes/natural resources in a particular area vary.

3. There are more or less available banks in a particular region vs another.

Because of these reasons, all major governments in this world found that it would be useful to have a central bank. Literally, every major country in this world has a central bank. In the United States, our central bank is called The Federal Reserve Bank. In a previous post I provided some of the responsibilities of the Federal Reserve Bank. One of the responsibilities I did NOT mention was its role in regulating all of the banks within our banking system. It makes clear sense that they would regulate all of the banks, it is the Central Bank. Now just because it is the central bank, doesn’t mean it has unlimited power. Actually it’s power is limited.

The Federal Reserve’s powers are limited to it’s relationships to banks and banks only. The Federal Reserve has the power to raise or lower the lowest interest rates (which effectively regulates the lowest interest rates all banks can lend at). This either increases or lowers the money supply we have in our country because it will push regular banks to either lend out more money or lend out less money. The Federal Reserve also regulates how much banks can lend to others using your money and mine. This is what we in finance call the “Reserve Requirement” which effectively means how much cash banks should have in reserve for each account they hold. Until yesterday the reserve requirement was 10%. Today it is 0%. This means banks can use all of the money you have in your account to lend to people for interest. The goal is to ensure that banks will use as much money as possible to lend to others at a time when they most need it. Like right now with COVID-19 (Coronavirus).

This is straight from the Federal Reserve Banks “Reserve Requirements” page.

To stimulate the economy the Federal Reserve relaxes its regulations on the banks to push them to lend more money to us. Another way the Federal Reserve stimulates the economy is by lending money to the United States. It does this by (you guessed it) buying Treasury Bonds from the Treasury Department. The Federal Reserve also stimulates the economy by buying bonds directly from banks (such as mortgage bonds). The Fed (Federal Reserve) also buys mortgage bonds from banks created by The Two Branches of government (Legislative & Executive) (Fannie Mae is an example). All so that the Two Branches can have extra cash to pay for social services (like welfare, or industry bailouts).

So the next time you see The Federal Reserve Bank dish out $2.2 Trillion, don’t say “They should have given us the money directly”, they don’t have the ability to, that’s the job of the Two Branches (The Legislative and Executive). If you want money directly in the mail, call your local Congressman and Senator, DON’T CALL OR BLAME THE FED. They couldn’t give us the money even if they wanted to, it’s beyond their power.

So what’s next? I think the Treasury Department WILL send checks directly to you. Yes, YOU. This is the most rare of occasions and I don’t know when this is going to happen but the US has never been in a state where NO ONE CAN leave their homes to go to work. The pressures on businesses are large. The only logical position here is to send EVERY Adult Money.

That’s it for today’s edition of The Dime💰.

Don’t be stingy with the 🏀. Pass it to a friend.