This post is a partial analysis of what’s affecting markets. The other portion is in The Black List archives. Any inquiries about The Black List, please email carl@raisingbenjamin.com

Okay. So the last two weeks have been INSANE. There is no other word to describe it. I’ve been stuck studying for the Bar exam and the MPRE (Ethics exam required for a law license) and I got your DM’s, The Black List has been BOOMIN so my free time has been spent in there. I dropped some hot takes on twitter (@cjoeblack), but now that some of the heat has passed. Here’s today’s (a special edition) of The Dime💰.

I saw markets taking an upcoming beating due to companies taking on too much debt (especially US Shale), I saw the FED getting stretched out because they were flooding the repo markets with cash to make sure financial institutions lend to each other at a desired rate, I even saw China having to take steps to end the Trade War because of African Swine Fever, BUT NEVER IN MY LIFE DID I EVER SEE THIS CORONAVIRUS BEING THE STRAW THAT BROKE THE CAMEL’S BACK.

WOWWWWWWW.

So today the Stock market posted its largest losses since Black Monday in 1987. Markets across the board fell a whole 7%. That’s BROLIC.

This week markets had to hit the “circuit breaker” TWICE. The purpose of hitting the “circuit breaker” is to basically manage stock order execution and to allow trading to balance out.

Like I taught y’all (too long ago) there are buyers and sellers. For every seller there’s a buyer. So if there are a shit ton of sellers we need to organize the sales and identify if there are buyers for that sale. That’s what the “circuit breakers” are for. Some folks think it’s a cheat code for the market in general. The orders are always delayed so it’s not really cheating. But psychologically I think it’s a way for the stock exchange to really make people chill the f*ck out and reconsider what they’re doing.

Sometimes we just need a minute to breathe.

So what caused this?

Yes, it was the Coronavirus (I call it “The Roni”).

As we’ve discussed through #MoneyMail, everything in the economy is connected. If a school closes, a farm loses a client for milk (and other foods), the electric company loses profit because the lights aren’t on, the gas company loses profit because the heat/stoves aren’t on, bus drivers have no kids to take to school, the oil company (gas station) loses money at the pump and so on AND SO ON.

So you and I see “work remote” as lit because we get to stay home, others see “work remote” as HELL ON EARTH.

You should be looking at your investments that way.

“Work remote” means that a new class of companies are going to thrive while another set of companies are going to not thrive as much. Some will hurt more than others but just know, this economy gonna hit different.

Also, there’s gonna be a bunch of stocks that’s gonna get lit off the panic and the increase in medical supplies, but in the mean time stocks gonna get they ass beat, because hey… that’s the game.

So during the process of the economy “hitting different” we’re gonna see a recession.

Yes, a recession, caused by the Coronavirus.

Like we stated, a closing means a bunch of attached jobs and companies lose money. So you’re def gonna see that reflect heavily.

Does this mean you’re going to lose your job? I can’t say that broadly, I don’t even know what all of y’all do.

We know the MLB, NHL, NBA is suspended which means commercial ad prices for media networks are going to take a hit, food & beverage suppliers for arenas are going to get hurt, bus drivers, electric companies, gas companies and other companies that supply that ecosystem all gonna get snuffed OD by that. Those jobs gonna get affected for sure. Now use this thought process for every single company that “closes” or is affected by a “closed” business. This is systemic.

Now what do companies usually do in times of trouble? They borrow money to see the time through.

But here’s the kicker…

Companies have already been borrowing too much damn money and to make things worse— because the ENTIRE economy is feeling the steam off this Coronavirus, EVERYONE is trying to borrow money AT THE SAME TIME.

So now we have stress in the credit markets.

This is an elite time to be a bond investor. It’s also a risky time, because YOU DON’T KNOW who is going to be able to pay you back because of this Coronavirus situation. We also don’t know how long this will last. This is why this whole thing feels like 2008. This is why markets are getting BRUTALIZED.

This is far from over so here’s a short recap:

Coronavirus is going to put companies in a position to make way less money.

Companies need to borrow money to see this time through.

Companies have to pay their current debts AND need cash to make it through the storm.

NO ONE knows which companies are going to be able to pay the NEW debts back if the loans are approved.

EVERYONE IS TRYING TO BORROW AT THE SAME TIME AND NO ONE IS TRYING TO LEND BECAUSE THEY NEED THE MONEY FOR THEMSELVES.

Nightmarish times. But this isn’t only because of the Coronavirus. NOPE. Saudi Arabia and Russia are large oil producers and these wild boys decided to go into a price war.

Saudi Arabia decided that they’ll flood the streets with oil until Russia caves in which will make the price of oil (gas) drop but here’s the kicker… IF NO ONE IS OUTSIDE BECAUSE OF THE CORONAVIRUS THEN THERE’S LESS PEOPLE OUT THERE TO BUY OIL AND GAS.

So oil and gas? A MESS.

AIGHT, what do we do?

The answer to this is a lawyers favorite answer to everything…. IT DEPENDS.

If you have a job that’s at risk… Imma keep it a stack with you my g…. Put as much money as you can in your bank account for a rainy day. Cause it might actually get rainy.

If you’re invested… DON’T DO ANYTHING.

1. It’s too early in the year to take that L and have to wait til next tax year to claim it.

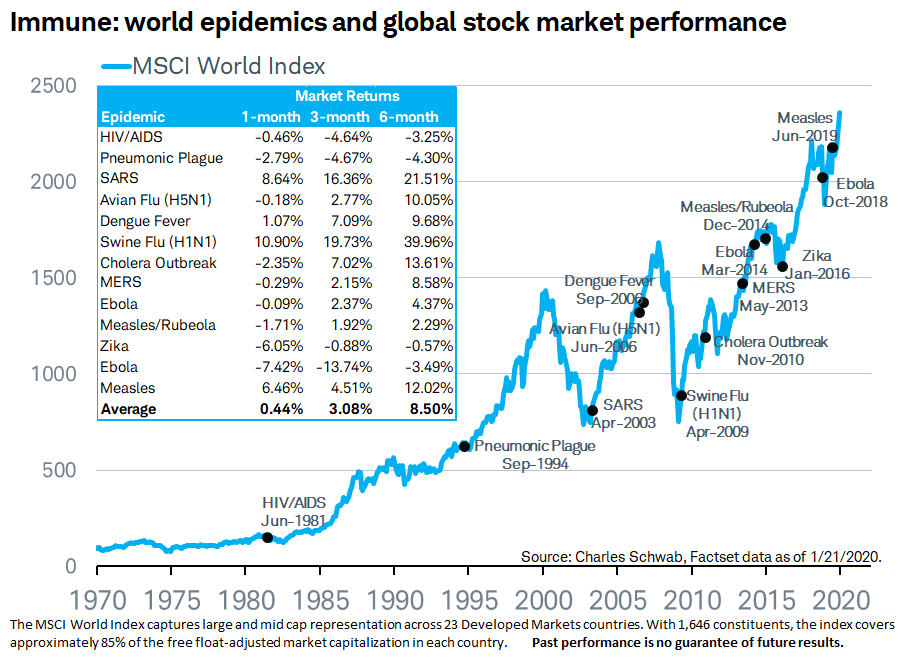

2. Think LONG TERM my g, we invest for years not for moments. Here’s a chart of how the market has done over the last 50 years. RELAX

If you don’t have a job that’s at risk (and you have money stacked like crazy)… If you have the stomach to risk money for the LONG TERM…

You need to start hunting.

I’m going to drop a few industries to begin your search and why (I can’t give you exact companies, I’d get jumped by the group chat).

Medical devices

More people going to the hospital means more uses for medical devices, more medical supplies, were talking from masks to syringes, medical equipment etc. Now we already knew that more people would be visiting hospitals because the country is getting older (and of course Obamacare/State expansions of medicaid) but now with Coronavirus a lot more folks are going to be in there.

Consumer staples

We’re talking about products that every person needs in their house. Anti-bacterial soap, Purell, food, items that are necessary for purchase whether there is a Coronavirus or not. Since people will be spending more time at home (and likely cooking more) these types of items will either be purchased in store or delivered directly to the home at a higher pace than before. Something else to consider is the amount of revenue these consumer staple companies are earning due to panic buying of items.

Is there more? Yes, but it’s not for y’all. It’s for The Black List. Don’t be stingy with the 🏀though, pass this to a friend.

Remember: This is not investment or financial advice. Go see your financial advisor and get advice from them. This is for educational purposes only.